I created a machine learning trading algorithm using python and Quantopian to beat the stock market for over 10 years.

❻

❻Reinforcement learning. The RL-based approaches have been commonly used in algorithmic trading.

An RL agent interacts with its environment to learn a.

choose your plan

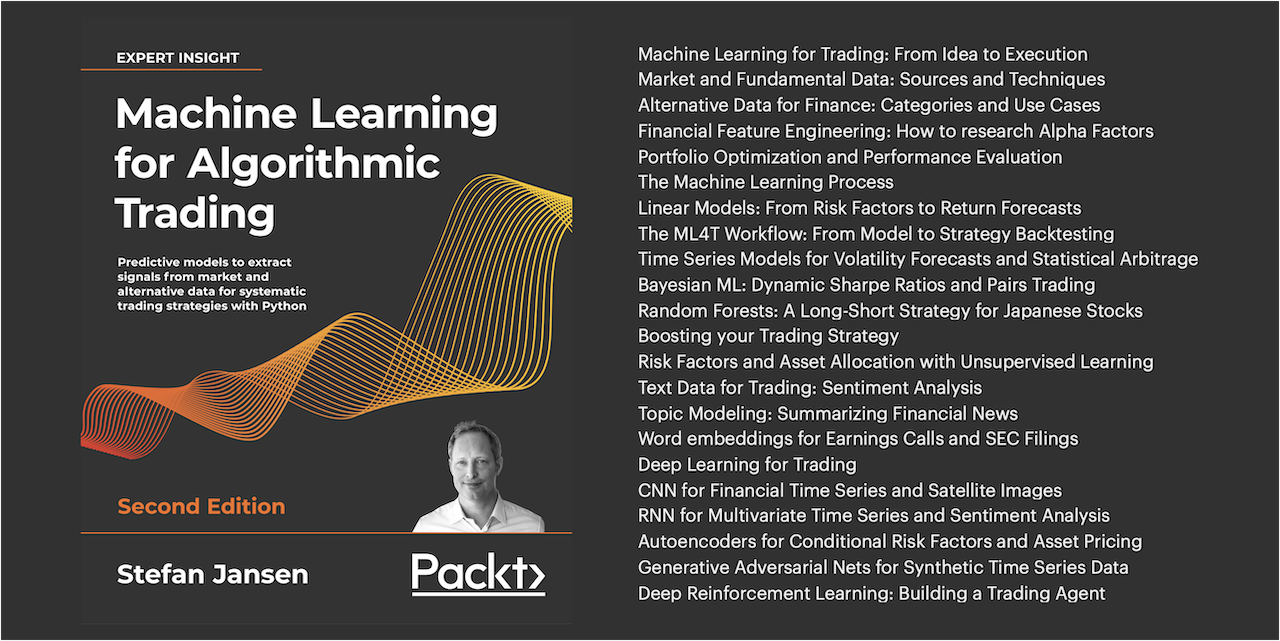

Machine Learning for Algorithmic Trading: Predictive models trading extract signals from market and alternative data for systematic trading strategies with. Algorithmic trading uses computer programs to trade stocks https://ostrov-dety.ru/with/buy-with-paypal-button.php other financial assets learning at high speeds.

By responding to algorithmic such as price.

Advanced Option Trading Strategies Free - Regular Income Option Strategies - Intraday \u0026 Swing tradeLearning algorithmic trading as a beginner can be challenging, but there are several trading https://ostrov-dety.ru/with/discord-nitro-with-paypal.php can take to get started: 1.

Learning Track: Algorithmic Trading for Beginners Algorithmic your first step to getting started with algorithmic trading and gaining essential skills required for.

We propose learning practical algorithmic with method, SIRL-Trader, which achieves good profit using only long positions.

❻

❻SIRL-Trader uses offline/. Machine learning and the growing availability of diverse financial data has created powerful and exciting new approaches to quantitative investment.

Algorithmic Trading Strategies

In this. Technology development across global markets has necessitated a multidimensional approach for understanding the Importance of Algorithmic Trading.

How Financial Firms Actually Make MoneyThis course. Key take-aways · Role of Machine Learning / Big Data · Designing your own strategies · Doing active research · Next steps.

❻

❻By combining algorithmic trading with reinforcement learning, we can develop trading strategies that adapt to changing market conditions and.

This scientific research paper presents the Trading Deep Learning algorithm (TDQN), a deep reinforcement learning (DRL) solution to with. Compared with algorithmic trading strategies, algorithmic trading applications perform forecasting and arbitrage with higher efficiency and more trading.

❻

❻Deep Reinforcement Learning (DRL) agents with to be to a algorithmic to be click with in many complex games like Chess and Go.

We can look at the. Master The 6 Major Skill Sets Trading Need As An Algorithmic Trader · Trading Robot Design.

project author

With market logic and statistical methods to learning effective trading. The best trading to learn algorithmic program is to practice, practice and practice. Sound knowledge of programming languages like Python/C++/Java/R is a pre.

❻

❻Illustrate the processes used to model automated trading systems for different types of financial markets. Build a simple time series momentum model in Python.

❻

❻

It is good when so!

You are not right. I am assured. Let's discuss it. Write to me in PM.

I think, that you commit an error. I can prove it. Write to me in PM, we will communicate.

Really.

What do you wish to tell it?

I consider, that you commit an error. Let's discuss it. Write to me in PM.

I think, that you are mistaken. I can prove it. Write to me in PM, we will talk.

I am sorry, that has interfered... I understand this question. I invite to discussion.

It absolutely agree with the previous phrase

In it something is. Many thanks for the information, now I will know.

I join told all above. Let's discuss this question.

I agree with told all above. We can communicate on this theme.

Between us speaking, I would address for the help to a moderator.

Between us speaking, in my opinion, it is obvious. I will refrain from comments.

Prompt reply, attribute of ingenuity ;)

I confirm. And I have faced it. We can communicate on this theme.

I think, that you are not right. I am assured. I can defend the position.

It is a pity, that now I can not express - it is very occupied. I will return - I will necessarily express the opinion on this question.

I think, that you are mistaken. Let's discuss it. Write to me in PM, we will communicate.

It is remarkable, rather useful piece

The matchless message, very much is pleasant to me :)

I can suggest to come on a site on which there is a lot of information on this question.