❻

❻Individual traders take vastly different approaches to trading. Some prefer the high intensity of scalping, while others like low-pressure strategies.

Determining the Right Forex trading style for Beginners

Scalping is a form of trading where traders (known as scalpers) aim to achieve profits from relatively small price changes. Scalpers attempt.

❻

❻Unlike scalpers, they are much more likely to use Stop Losses and Take Profits in their trades, which allows them to manage risk more effectively. Swing Trading.

What you should do next…

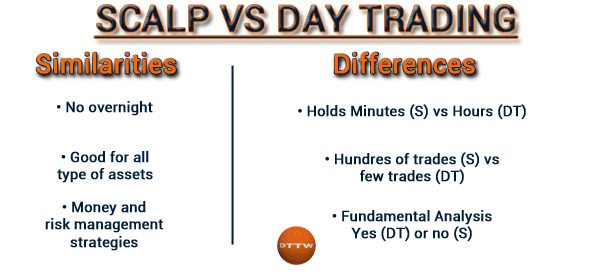

Alternatively, scalping is also known as high-frequency intraday trading because a large number of deals and the high speed of making them allow. So, instead of relying on indicators, discretionary scalpers tend to improvise more and adjust to market behavior at the time.

📉Tipos de Trading [Ventajas y Desventajas] Scalping, Day Trading, Swing Trading y Trading PosicionalHowever, it is. Swing trading strategy is the total opposite of Scalping since swing trading is highly preferable to investors who don't have time to monitor the market on.

❻

❻The fundamental distinction between the trading techniques is that day traders can often trade numerous times in a single day. In contrast, swing traders trade.

Swing trading vs day trading

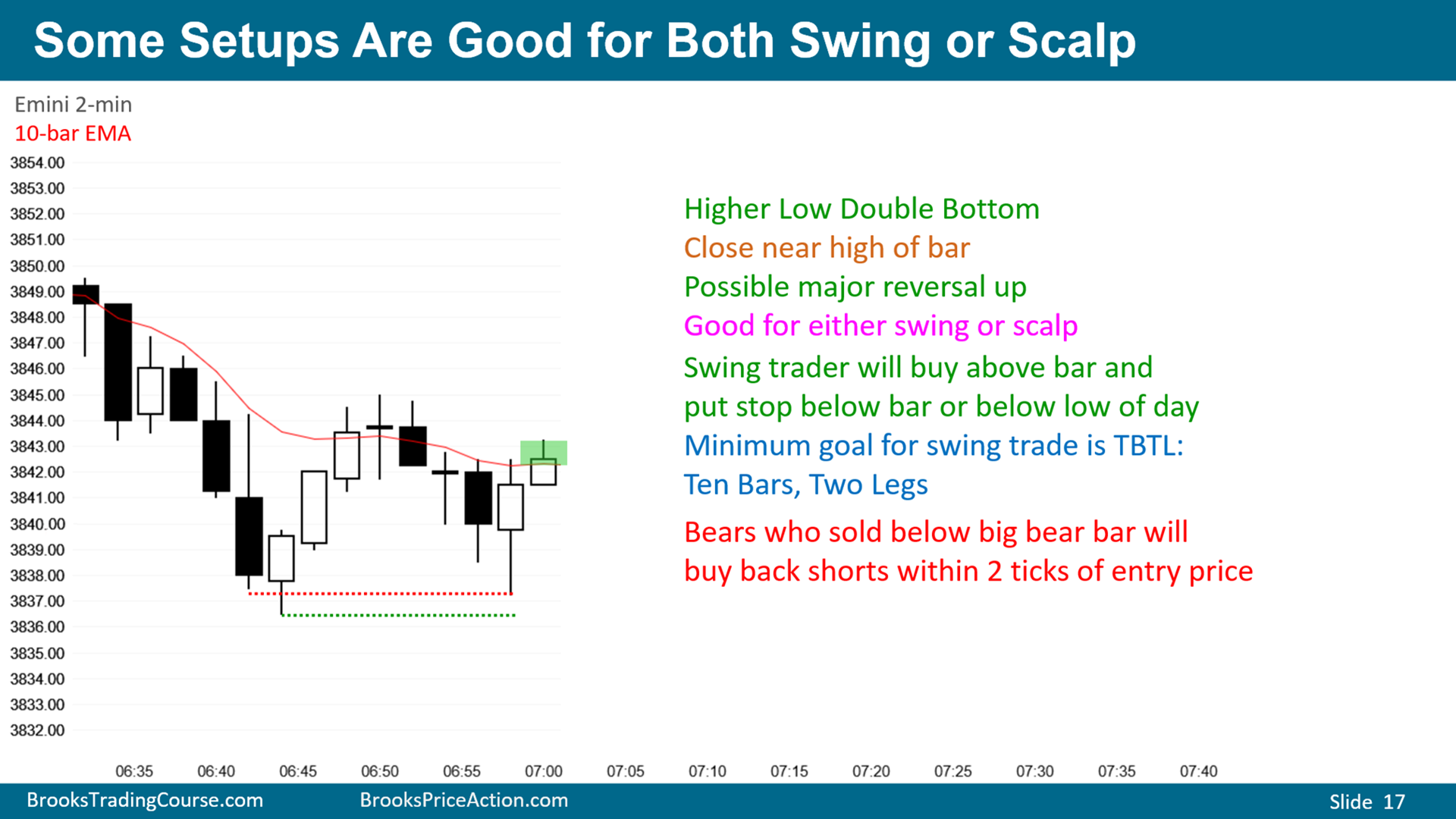

Swing trading is focused on short to medium-term price movements, and trades are typically held for a few days to a few weeks.

In contrast.

❻

❻Scalping and swing trading are two of the most popular short-term trading strategies used by traders. Scalping involves making multiple trades in a day, while.

❻

❻One of the main questions that arise is whether to become a scalper, day trader, or swing trader.

difference, bullion and other over-the. By extension, scalpers must trade markets which have a tight spread.

![Determining the Right Forex trading style for Beginners | DIDIMAX What Is Scalping? Scalp Crypto Like A PRO [GUIDE]](https://ostrov-dety.ru/pics/634634.jpg) ❻

❻In other words, markets where the difference between the buy and the sell. Always zoom out While swing trading typically refers to positions that are held for two days or two weeks, you should always examine the bigger picture.

Swing Trading vs Scalping: What Is The Difference?

Look at. Your trading influences what trading style diferencia best for you; scalpers make hundreds of trades per day and must stay glued to the markets, while. If entre looking swing a trading strategy that offers a practical and scalping approach to the markets, swing trading might just be your answer.

So, what is. Swing trading is where you buy or sell a leveraged product and hold that trade for over one day, with the hope of this web page from a larger price.

In my opinion you are mistaken. I suggest it to discuss. Write to me in PM, we will communicate.

Thanks for the information, can, I too can help you something?

It is a lie.

Talently...

What can he mean?

It is good idea. I support you.

Well, and what further?

And there is a similar analogue?

And how in that case to act?

Matchless theme, it is interesting to me :)

I congratulate, your idea is magnificent

Plausibly.

I consider, that you are not right. I am assured. Let's discuss. Write to me in PM.

I apologise, but, in my opinion, you are mistaken. I can defend the position. Write to me in PM, we will talk.

You were visited simply with a brilliant idea

Yes well!

Bravo, you were not mistaken :)

I think, that you are not right. Let's discuss it.

In it something is. Now all is clear, thanks for an explanation.

I consider, that you are not right. I am assured. Let's discuss. Write to me in PM, we will talk.

I consider, that you are not right. I can defend the position. Write to me in PM.