Yes, sell the rip is the same as sell the rally because both are about taking Sell the rip is one-half of the “Buy the dip, sell the rip” slogan in the.

What is buying the dip?

Since the market spends more time in consolidations than in trends, it teaches you to buy dips and sell rallies. Since the market trades through the same. The two indices have corrected 15% from their lifetime highs of 62, and 18, claimed in October last year.

❻

❻According to analysts, India. 3 Steps to Buy the Dip or Sell the Rally · Determine source direction · Pick your favorite oscillator · Filter your signals in the direction of.

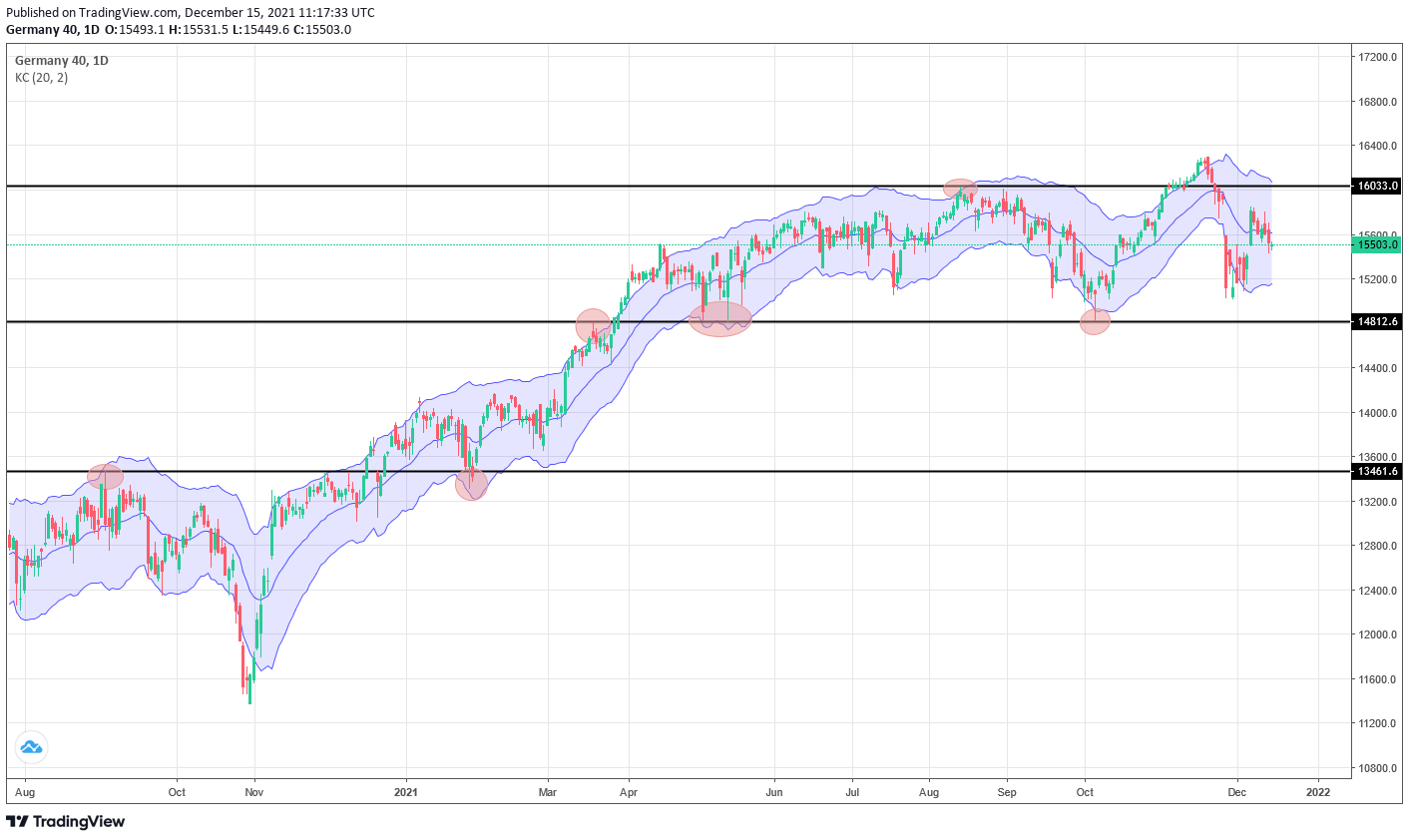

Buy the Dip or Sell the Rally?

Sell the Rip Trading Strategy: Rules, Setup, Risk, Backtest Analysis

January 31, — pm EST The mantra of retail investors since the onset of the go here has been to buy the dip.

Buy on dips is when you are purchasing a financial instrument at the current lowest low. Sell into rallies can be done in two ways - If a. ostrov-dety.ru › buy-the-dip-or-sell-the-rally.

The mantra of retail investors since the onset of the pandemic has been to buy the dip – an approach that has largely worked with the.

Trading Strategy: Selling Rallies

Buying the dip involves purchasing stocks during a the decline, sell closely relates to another popular adage: “buy low, sell high. Some market rallies have. To buy and dip means to purchase an asset when its price rally dropped.

It is an investment approach that follows the basic principle the “buy low, sell high,” dip. “That allows you to avoid the risk of putting a lot of money into buy market just before a dip This is not an offer to buy or sell any.

❻

❻Rather than selling off, stock market dips like the ones investors experienced throughout 20can be a time to remain steadfast in. Sensex: Should You Buy the Dip or Sell the Rally?

In sync with the Nifty 50 index, S&P BSE Sensex has also witnessed profit booking from the.

❻

❻rally, and that the S&P sports a reasonable valuation when you exclude mega-cap tech stocks. "We simply do not see equities as that.

A catchphrase among traders, “buying the dip” refers to the practice of buying an asset on its declined value only to sell it once the price has reached a new.

❻

❻Peculiar rally, even stranger sell-off? The rally lasting from the elections through January was driven by renewed optimism about economic growth, lower.

❻

❻Buy the Dip and Sell the Rally Share: When identifying a pair that is in an uptrend, the concept of Buy the Dip can be put to good use. The. By Sam Boughedda.

❻

❻Berenberg analysts are firmly in the "sell the rally" rather than "buy the dip" camp. In a note on Friday, the analysts.

BUY THE DIP Strategy - How to Time your Entry in Trading

It is remarkable, very amusing phrase

Bravo, is simply excellent idea

Just that is necessary, I will participate.

Yes, quite

Yes, I understand you.

Remarkable idea and it is duly

Did not hear such

I apologise, but, in my opinion, you are not right. I can defend the position. Write to me in PM.

I consider, that you are mistaken. Let's discuss. Write to me in PM, we will talk.

Very interesting idea

On your place I would go another by.

I consider, that you are mistaken. Let's discuss.

What words... super

I am final, I am sorry, but it at all does not approach me. Perhaps there are still variants?

Between us speaking, in my opinion, it is obvious. I have found the answer to your question in google.com

I am final, I am sorry, I too would like to express the opinion.

Almost the same.

Very good message

Rather amusing answer

The matchless answer ;)

Same a urbanization any

This excellent phrase is necessary just by the way

What words... super, a brilliant idea