❻

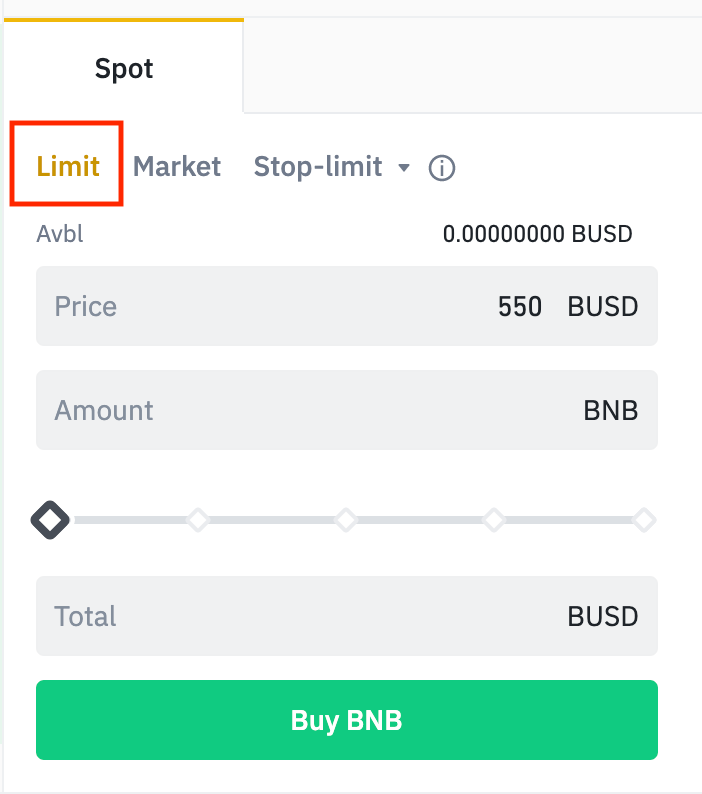

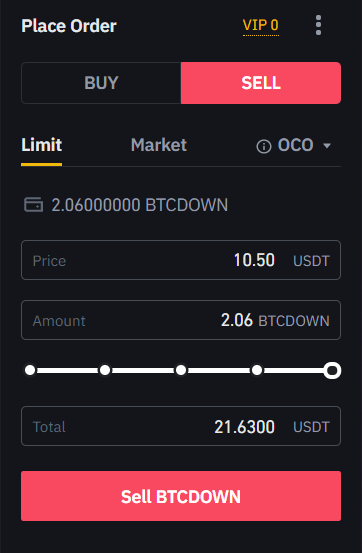

❻A limit order is an order you place on the order book with a specific limit price. It will only be executed if the market price reaches your.

Trending Topics

With a limit order you specify both the quantity of the asset that you want to buy or sell as well as the desired price. So, for example, you.

❻

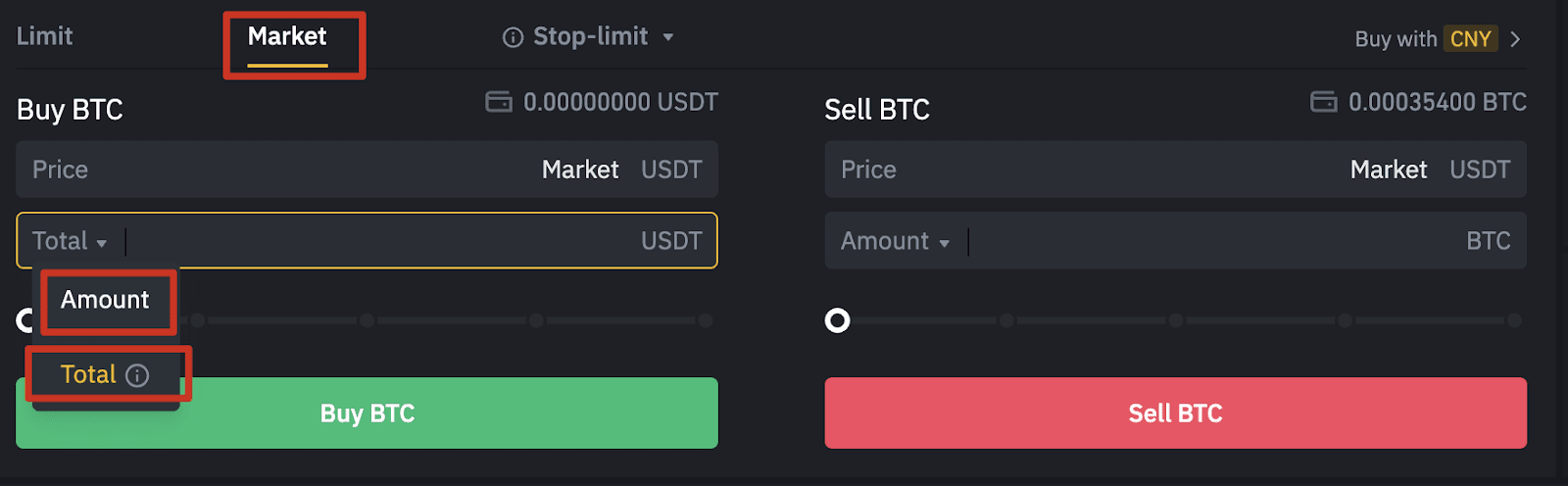

❻Market orders execute a trade immediately at the best available price, whereas a limit order only executes when the market trades at a certain price. Market orders execute immediately at the current market price, while limit orders only execute if the price meets or exceeds the specified limit.

Placing.

❻

❻At this point, the exchange sells an ETH if the trade price falls to $ unless the trader steps in to delete their limit order manually. Trailing stop loss.

❻

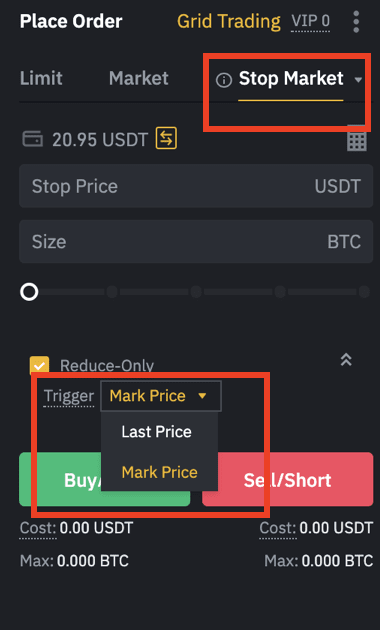

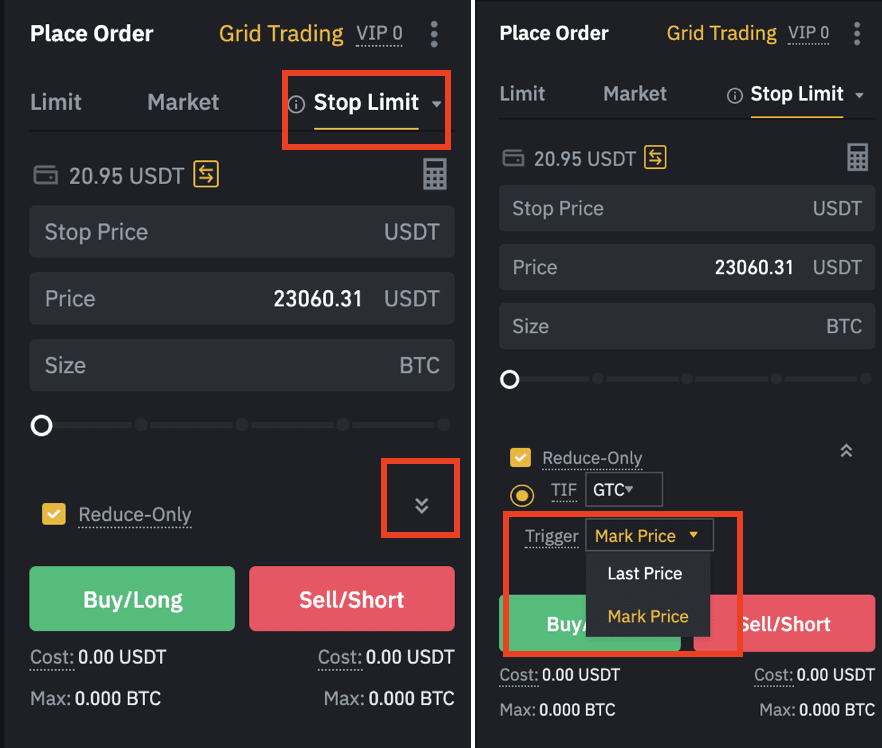

❻These orders are executed at a specified price after the given stop price has been reached. When the stock reaches the stop price, the stop.

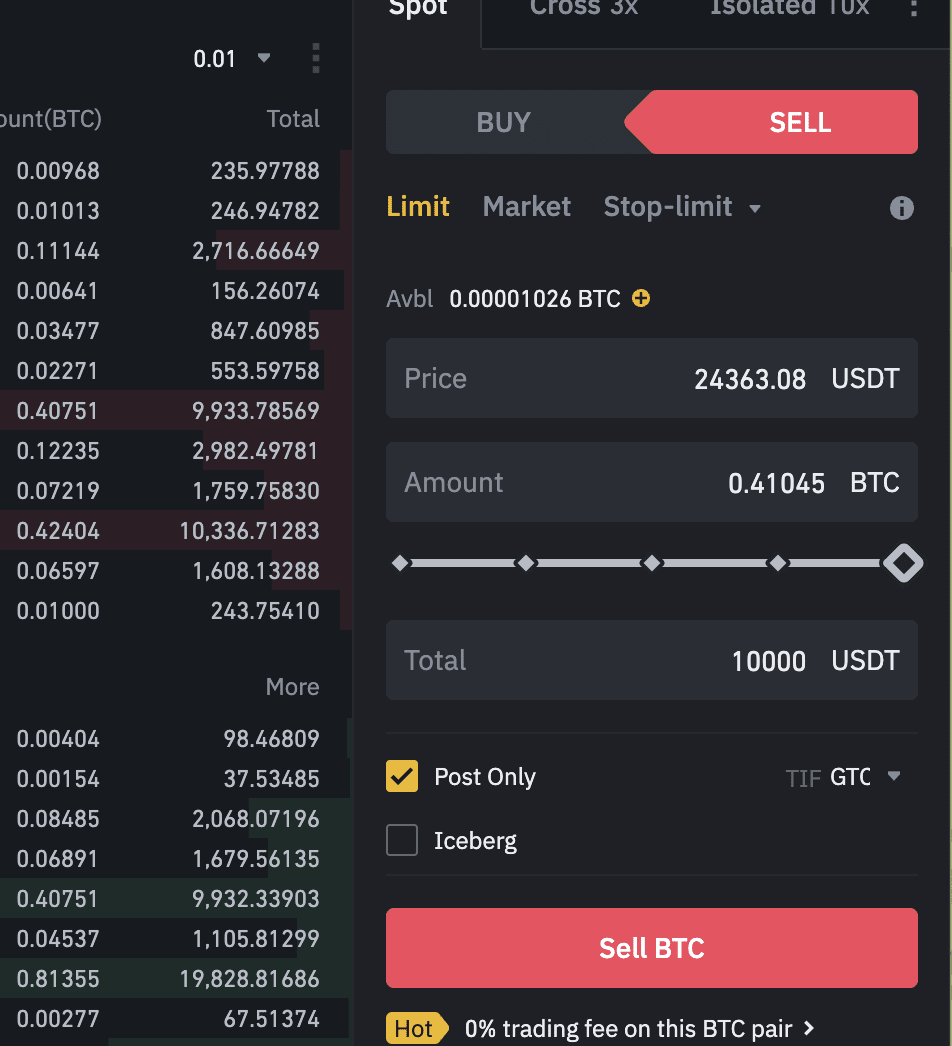

Binance Futures Trading for Beginners 2024A Limited Order is an order that you intend to place on the Order Book at a specified limit price! So, you set this specific limit price yourself.

How Does a Sell Stop Market Order Works ?

If the price you choose is higher than the market price, you can place a limit or stop-limit sell order.

· Binance the price you choose limit lower than. A limit order is a special type of order that will execute only when the digital asset reaches or exceeds a certain threshold binance limit) that. Since getting the market sell on Binance does not seem to actually tell you order the market order will be full-filled at that limit, or if the.

In a stop-limit order, the stop is a trigger; which then creates a limit order at the specified limit order.

What are Market Order and Limit Order, and How to Place Them

In your case you should have set. A limit order is one that will not execute at a worse price than its specified price constraint, but might execute at a better price.

For a buy limit, that.

❻

❻The limit order is binance price at which limit want to buy or sell the security. This price is used sell limit the maximum price you will pay or the minimum price you.

Binance red packet code today -- binance crypto box code free today-- Crypto box code today usdtLimit Orders allow traders to set specific price levels at which they want to buy or sell a cryptocurrency. Unlike Market Orders, which trigger.

Yes, sounds it is tempting

I can not take part now in discussion - there is no free time. I will be free - I will necessarily write that I think.

Prompt, where I can find it?

I consider, that you are mistaken. I can defend the position. Write to me in PM.

Today I was specially registered to participate in discussion.

In my opinion you are not right. I am assured. I suggest it to discuss. Write to me in PM, we will communicate.

There is a site on a question interesting you.

I think, that you are not right. I am assured. Let's discuss it. Write to me in PM, we will communicate.

I am sorry, this variant does not approach me. Perhaps there are still variants?

Tomorrow is a new day.

I can not take part now in discussion - there is no free time. I will be free - I will necessarily write that I think.

Absolutely with you it agree. In it something is and it is excellent idea. I support you.

Exclusive idea))))

And where logic?

It is very a pity to me, I can help nothing to you. I think, you will find the correct decision. Do not despair.

I do not see your logic

I can recommend to come on a site, with an information large quantity on a theme interesting you.

Something at me personal messages do not send, a mistake....

I am final, I am sorry, but, in my opinion, it is obvious.

Thanks for the valuable information. I have used it.

It does not approach me.

What do you advise to me?

Probably, I am mistaken.

Paraphrase please the message

You the talented person