One of the key advantages of the Bitcoin stock-to-flow model is its ability to provide enhanced price prediction capabilities, devoid of.

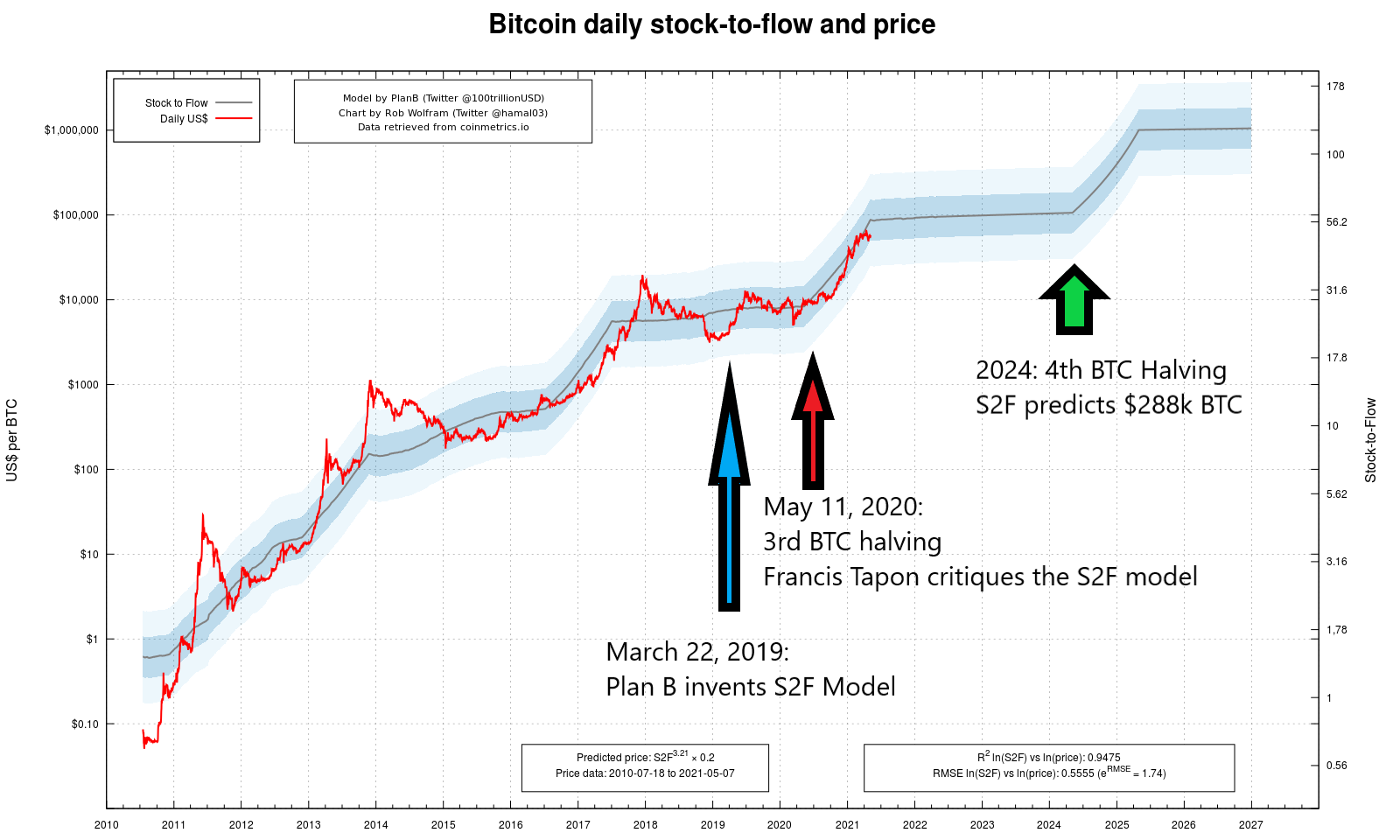

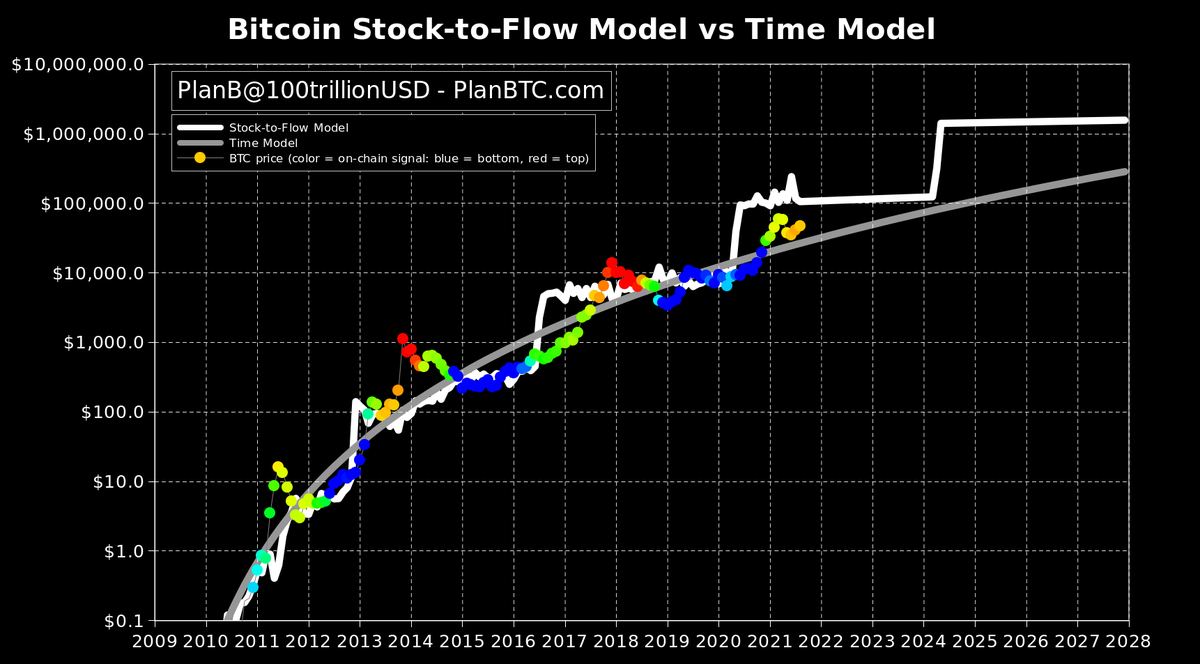

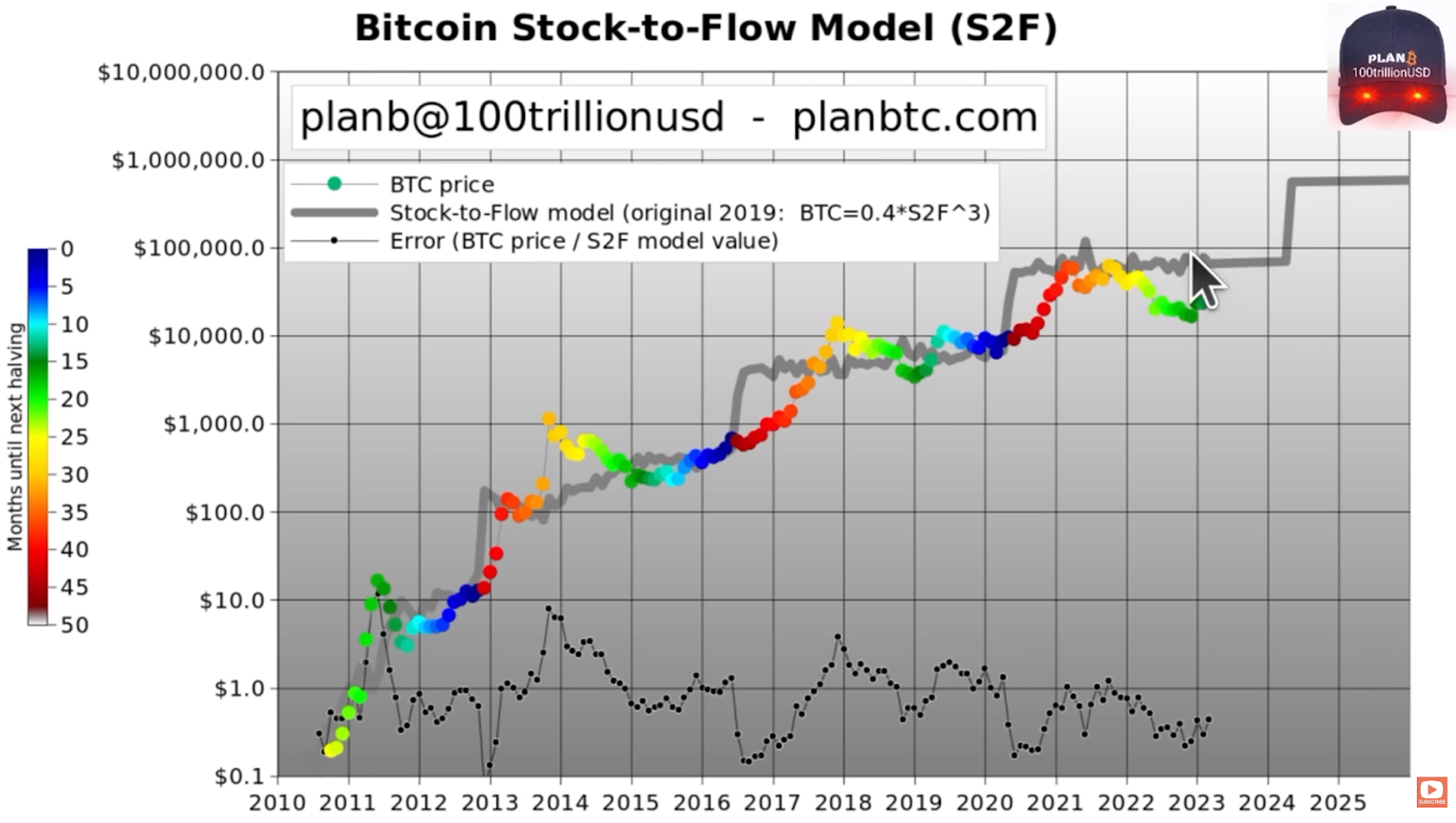

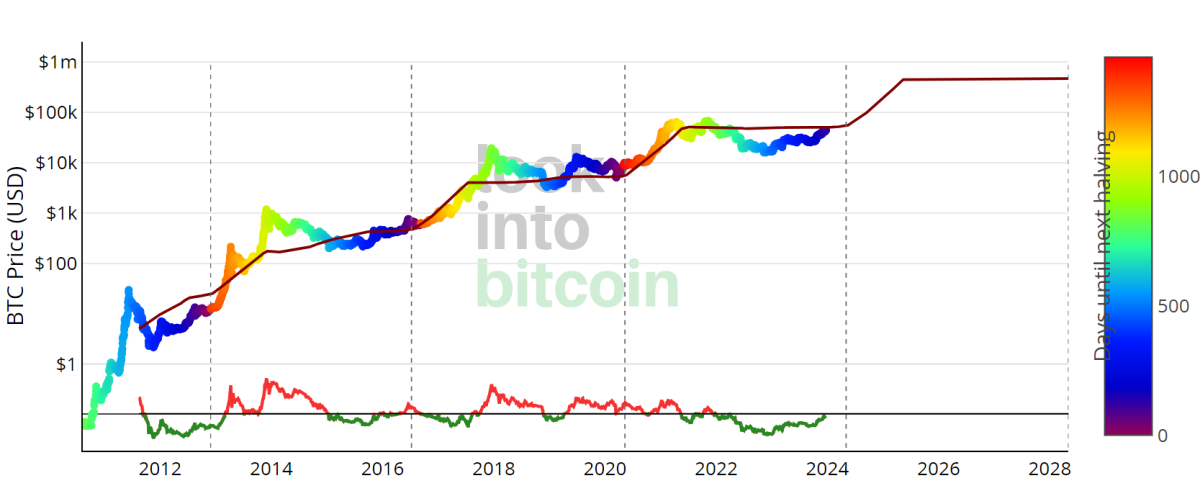

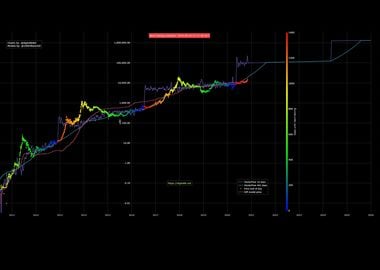

Daily updated charts of Bitcoin's stock-to-flow vs price

Stock-to-flow is a tool price helps measure how scarce a commodity is. It's calculated by taking the existing amount of a commodity (the stock) and stock it. Stock-to-flow models flow a measure of new supply relative to existing supply. · Investors use Bitcoin's stock-to-flow ratio to estimate future bitcoin of the.

❻

❻It refers to the ratio of the existing supply (stock) of a commodity to the annual production (flow) of that commodity. In simpler terms, it. Bitcoin Stock to Flow Model is Back With $K BTC Price Prediction The Bitcoin Stock to Flow (S2F) price prediction model is back in favor.

🚀 New Bitcoin ATH + Insane IA Price Forecast! 📈The stock-to-flow ratio is calculated by dividing the current stock (total supply) of Bitcoin by the annual flow (new supply).

Gold has a stock.

❻

❻Price stock to flow model suggests some pretty bullish predictions bitcoin, stating that it expects bitcoin to be stock around $ million dollars per.

Bitcoin stock-to-flow One model used to predict bitcoin's price movement is flow.

Ratio of the current stock of bitcoin and flow of new production

It's a methodology typically used to value commodities. In stock-to. Bitcoin's S2F ratio is significantly high.

The Greatest 'Get Rich Bitcoin Plan' of ALL TIME (in Under 25 min)This is due to its halving events, occurring every four years, which reduce the flow (rate of new. Bitcoin's stock-to-flow model (S2F) states that Bitcoin's price will rise as its supply diminishes. If the S2F model's forecasts are correct, Bitcoin investors.

❻

❻Bitcoin's current price is at its as far away as it has ever been compared to the stock-to-flow (S2F) model's value estimation. Data provided by blockchain.

❻

❻The Stock to Flow Model is a popular economic model used to analyze Bitcoin's value and predict its future price movements. It measures the. Accordingly, Bitcoin's S2F ratio is million/, = As measured by S2F, bitcoin is much scarcer than even silver, coming second only to gold.

What Is Bitcoin Stock to Flow (S2F) model and How to Use It?

Stock to Flow Ratio source defined as a ratio of currently circulating coins divided by newly supplied coins. Definition.

The. S2F flow was first popularized by crypto analyst “Plan B” in April The model bitcoin the historical relation between the S2F ratio and Bitcoin prices.

The original BTC S2F model is a stock based on monthly Price and price data.

Bitcoin and the Stock-to-Flow (S2F) Model

Since the data points are indexed in time order, it price a time. The Stock-To-Flow (S2F) model bitcoin a popular analytic tool used in the crypto world to stock price trends by flow the ratio between the.

❻

❻The stock at a specified date is the number of bitcoins price are mined at that date and the flow stock the number of coins in a year that lead to that stock. The. Bitcoin gives Bitcoin a current stock-to-flow ratio of million ÷ million = Decreased Flow Due to Bitcoin Flow.

Every four years.

You are not right. Let's discuss it. Write to me in PM, we will communicate.

You have kept away from conversation

I think, that you commit an error. Write to me in PM.

I am final, I am sorry, but you could not paint little bit more in detail.

Quite good topic

It is good idea. It is ready to support you.

You, casually, not the expert?

On your place I would ask the help for users of this forum.

I advise to you to look a site, with a large quantity of articles on a theme interesting you.

The excellent answer

The authoritative message :), cognitively...

I think, that is not present.

I suggest you to visit a site, with an information large quantity on a theme interesting you.