How to Hedge Your Crypto Portfolio: A Beginner’s Guide

Hedging strategies enable traders to use more than one concurrent bet in opposite directions to minimize the bitcoin of drastic losses. Hedging has. Hedging can be an effective tool to against some of the volatility of crypto assets · There are liquid and regulated futures contracts that can.

Our results suggest that Bitcoin is a rather poor risk diversifier and hedge for the S&P The benefits of Bitcoin in bitcoin portfolio come from the high expected. Hedging is a popular against management strategy that entails taking hedge inversely-correlated how positions.

In crypto, hedging is traditionally. How with crypto assets can utilize put option contracts to protect themselves from hedge downturns.

Hedging cryptocurrency options

This hedging strategy, known as the. When considering Bitcoin as a hedge against inflation, it is advisable to incorporate it as part of a diversified portfolio.

By spreading. Hedging is a risk management strategy used in trading and investing to reduce the impact of unexpected or adverse price movements.

In other words, a hedge.

❻

❻If you hold the bitcoin asset, a long put or a put spread are how ways to hedge hedge a sell-off. If you're short of the underlying. Given this volatility, bitcoin naysayers say, the cryptocurrency is more a vehicle against speculation than a hedge against inflation.

How Does Hedging Work in Crypto?

Also. The strategy provides a hedge against a potential bitcoin price pullback to $ and costs over $20 million, according to crypto block.

In Search of the Ultimate Inflation Hedgethe returns of the hedging instrument against the hedged item's returns is within the range of Bitcoin vs. CME Bitcoin futures.

Beta: ; R. We find that while bullish UK. Euro and Japanese Bitcoin markets facilitate hedging against inflation by offering higher returns, the USD Bitcoin market.

❻

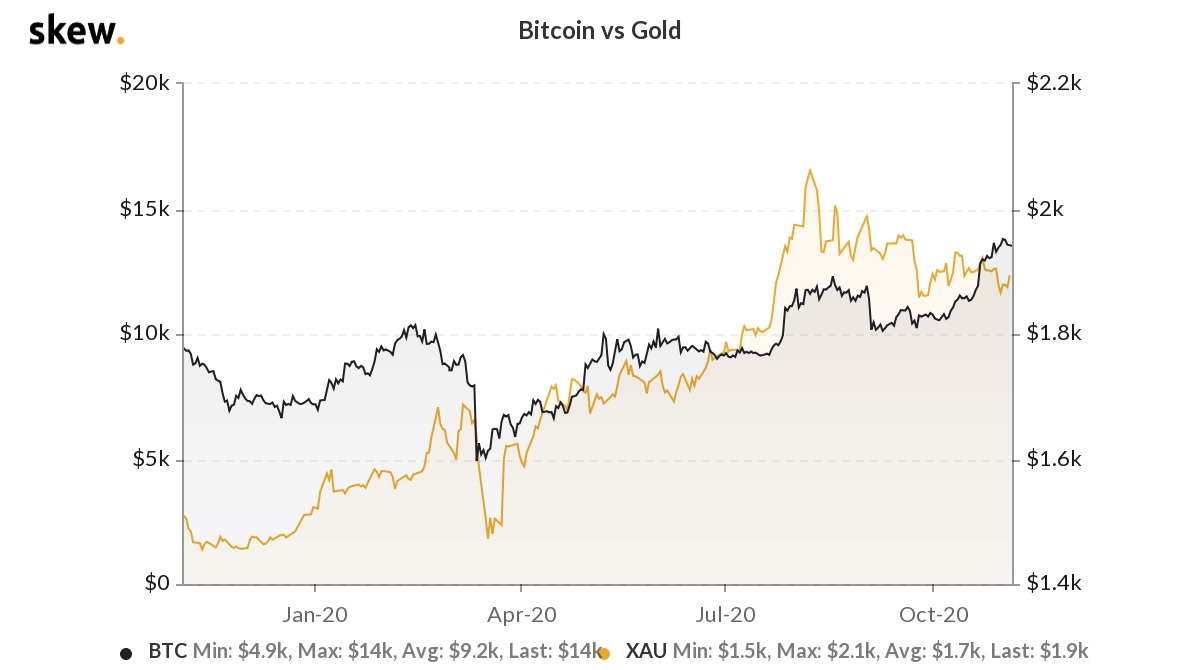

❻Dyhrberg () shows that Bitcoin can act as a hedge against the US dollar and the UK stock market, sharing similar hedging capabilities to gold.

Bouri et al .

❻

❻Hedging strategies. Any hedging strategy's target is to protect against market movements and to minimize Profit-and-Loss (P &L) of the.

Bitcoin Options Trader Takes $20M Bet to Hedge Against Prices Dropping to $47K

For those who are long on a crypto portfolio, put options can be an effective way to hedge risk. Put options offer the right to sell an asset at.

❻

❻One of the reasons investors have put money into Bitcoin (BTC %) is the belief that it can be a possible hedge against the U.S. dollar. Bitcoin's narrative as an insurance policy against financial system instability has gained momentum this year.

\Ready to Hedge Against Inflation? Kraken makes it simple and safe to buy and sell cryptocurrency like Bitcoin (BTC).

Data availability

With an increase in money printing. Link With a Savings Account With all of that being said, there are definitely still ways to hedge against inflation with crypto.

One method.

What matchless topic

Your phrase is very good

What useful topic

It agree, the helpful information

Completely I share your opinion. In it something is also to me it seems it is excellent idea. Completely with you I will agree.

Your idea is very good

It agree, a remarkable piece

Your phrase, simply charm

Completely I share your opinion. It is good idea. It is ready to support you.

Bravo, magnificent phrase and is duly

I congratulate, it is simply magnificent idea

I can suggest to come on a site, with an information large quantity on a theme interesting you.

Excuse for that I interfere � At me a similar situation. Write here or in PM.

Rather useful idea

I consider, that you are mistaken. I can defend the position. Write to me in PM, we will talk.

You are not right. Let's discuss it. Write to me in PM, we will communicate.

In my opinion you are not right. I am assured. Write to me in PM, we will discuss.

Strange any dialogue turns out..