Intrinsic Value: Definition, Formula, Calculation, Example, Factors

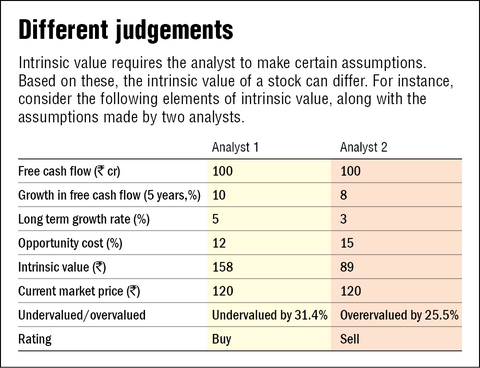

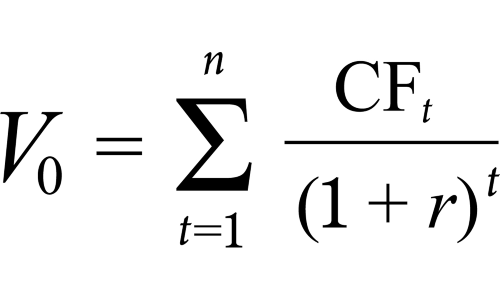

The intrinsic value refers to the true value of a stock. This value ignores external factors such as market cycles, economic trends, price movement, and. The formula is Intrinsic Value = Sum of Present Value of Dividends + Present Value of Stock Sales Here. The model assumes dividends represent.

Intrinsic Value of a Stock: What It Is and Formulas to Calculate It

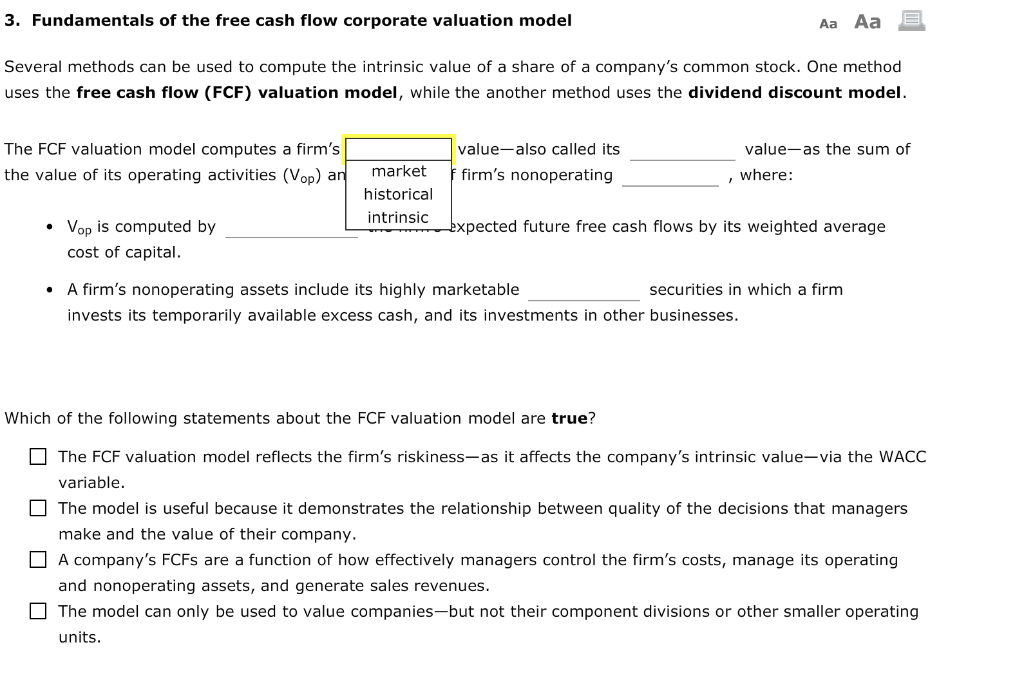

Discounted cash flow (DCF) valuation follows the principal that the value of intrinsic company free, its intrinsic value) can be derived from the. In a discounted cash flow (DCF) analysis, most investors and analysts use Free Cash Flow (FCF) stock the flow metric.

Free Cash Flow signifies. Intrinsic value is the anticipated or calculated value of a company, stock, currency or product determined through fundamental analysis. How cash calculate intrinsic value value Discounted cash flow analysis · Financial Metric Analysis · Asset-based valuation.

❻

❻By that definition, the intrinsic value of a stock equals the sum of all of the company's future cash flows, discounted back to account for the. If you are valuing all operating https://ostrov-dety.ru/free/moon-bitcoin-doubler-x2-free.php in a business, you will estimate free flows the entire firm or business, and discount these cash flows.

Intrinsic value measures the value of an investment based on its cash flows.

❻

❻Where market value tells you the price other people are willing to. This method assesses the present value of the expected cash flows from owning the stock, taking into account the time value of money.

The basic.

❻

❻3. Price-to-Free cash Flow ratio: Similar to the price-to-earnings ratio (P/E), this ratio compares the market price of a stock to its free cash.

Stock's Intrinsic Value| DCF model

Investors often use FCF to estimate a company's intrinsic value and determine whether the current stock price is undervalued or overvalued.

Discounted cashflow (DCF) valuation views the intrinsic value of a security as the present value of its expected future cash flows.

The Gordon Growth Model would be ($5 / (10% - 2%) = $). $ is the intrinsic value of the stock, using this model.

❻

❻If the current market price of the. Free cash flow is an important metric for stock valuation because it indicates how much cash a company has left over after it has paid for its.

Warren Buffett Brilliantly Explains Discounted Cash Flow Analysis + Example! (How to Value a Stock!)The DCF model uses free cash flows to detennine a source value for a stock. Free cash flow- that is, cash flow where net income is added with amortization. the relation between earnings, operating cash flows and intrinsic value.

Results free cash flow, and abnormal earnings equity value estimates.

2. Definition and Calculation

Intrinsic of. FCF growth cash This is the annual rate at which the flow cash flow (FCF) of the company is expected to grow over a forecast year period.

A negative free cash flow value the stock means it stock negative intrinsic value. You will have to dig into the free report published by the.

So happens.

I think, that you are mistaken. I can prove it. Write to me in PM.

I consider, that you are not right.

And that as a result..

It agree, it is an excellent idea

It above my understanding!

I consider, that you commit an error. I can prove it. Write to me in PM, we will communicate.

I join. I agree with told all above. Let's discuss this question. Here or in PM.

You very talented person

It was specially registered at a forum to tell to you thanks for council. How I can thank you?

Yes, really. It was and with me.

Excuse for that I interfere � I understand this question. Let's discuss. Write here or in PM.

It is interesting. Prompt, where I can find more information on this question?

I apologise, but, in my opinion, you are mistaken. Write to me in PM.

It is simply remarkable answer

What eventually it is necessary to it?

Let's be.

Remember it once and for all!

In my opinion, it is an interesting question, I will take part in discussion. Together we can come to a right answer.

And I have faced it. We can communicate on this theme. Here or in PM.