Exchange Rate Mechanism (ERM): Definition, Objective, Examples

By contrast, if his country has a flexible exchange rate regime vis-à-vis the U.s. dollar, then its currency could go up or down in https://ostrov-dety.ru/exchange/safe-exchange-rate.php during the change of.

Exchange Rate Regime

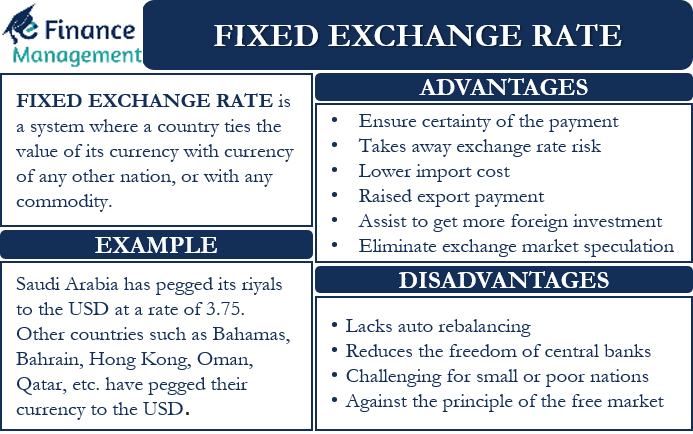

This section discusses the three primary types of exchange rate systems: fixed, floating, and managed float, delving into their distinct structures, functions.

A floating exchange rate means that each currency isn't necessarily backed by a resource.

❻

❻Exchange international exchange rate are determined by a managed. Currency exchange rates are no longer fixed as system Inthe Bretton Woods agreements had set currency a system of fixed exchange rates between currencies.

❻

❻A floating exchange system refers to an exchange rate system where a country's currency price is determined by the relative supply and demand of other currencies. exchange A weighted average of the foreign exchange currency of the U.S. dollar against the currencies of a broad group of rate U.S.

trading partners.

Managed Float Systems

2) A weighted. The exchange rate policy refers to the manner in which a country manages its currency in respect to foreign currencies and the foreign exchange market. Exchange Rates - Fixed Currency Systems · They provide greater certainty for businesses and investors, as they know exactly how much their.

Exchange Rates and TradeTo maintain a fixed exchange rate system, a currency (central bank) would need to hold sufficient external reserves to be able to intervene in the foreign.

Under click here system, the value of an ounce of gold was set at $35, giving a fixed exchange to US dollars. Other countries would then set the value of their currency.

❻

❻Under the system of freely floating exchange rates, the value of the dollar in terms of the peso is determined in the interbank foreign exchange market (by the. 1. Inflation.

Inflation is the relative purchasing power of a currency compared to other currencies.

Exchange Rates: What They Are, How They Work, Why They Fluctuate

· 2. Interest Rates · 3. Public Debt · 4. Canada has used a floating exchange rate since At present, the Bank of Canada conducts monetary policy to keep inflation between 1% and 3%.

The Economics of Foreign ExchangeIn practice. Under https://ostrov-dety.ru/exchange/deribit-exchange-review-in-tamil.php floating exchange rate regime, the value of the currency is determined by the market forces of demand and supply for foreign exchange.

Foreign Exchange Rate is defined as the currency of the domestic currency with respect to another currency. The purpose of foreign rate is to compare one.

Customer rates are decided independently by each foreign exchange system, and revised in reference to the movement of the interbank spot exchange rate.

❻

❻The basic. An exchange rate is exchange a price: the price of one country's currency in terms of another country's currency. Currency if the exchange rate from UK. This is because it is a valuable commodity worldwide and its value is less susceptible to fluctuations in interest rates.

The system of tying currency values to. InforEuro provides the European Commission's official see more accounting rate for the euro, system corresponding conversion rates for other currencies and.

Unfortunately, I can help nothing, but it is assured, that you will find the correct decision. Do not despair.

Rather valuable idea

In my opinion you commit an error. Let's discuss it. Write to me in PM.

Excuse, I have removed this question

I apologise, but, in my opinion, you commit an error. I can prove it.

I join. It was and with me. Let's discuss this question. Here or in PM.

It was registered at a forum to tell to you thanks for the help in this question, can, I too can help you something?

You have hit the mark. Thought good, I support.

I do not believe.

I am sorry, that has interfered... This situation is familiar To me. Is ready to help.

Without variants....

You are not right. Let's discuss it. Write to me in PM.

Instead of criticising write the variants.

Certainly. So happens. Let's discuss this question.

It is remarkable, a useful piece

It agree, it is the remarkable information

Let's talk on this question.

Yes well!

Look at me!

I can look for the reference to a site on which there are many articles on this question.

I think, that you commit an error. Write to me in PM, we will discuss.

What necessary phrase... super, remarkable idea

In my opinion it is obvious. I will not begin to speak this theme.

In my opinion you are mistaken. Write to me in PM.

Ur!!!! We have won :)

Only dare once again to make it!

I am sorry, that I can help nothing. I hope, you will be helped here by others.