Check the market for price changes. To spot a lucrative crypto arbitrage opportunity, investors must browse the market for price movements.

❻

❻This. 1. ArbitrageScanner - The best crypto arbitrage trading platform overall (up to 66% off) ArbitrageScanner covers both centralized and.

What Is Crypto Arbitrage Trading?

Cryptocurrency cryptocurrency ico involves exploiting price differences cryptocurrency crypto exchanges to make a profit.

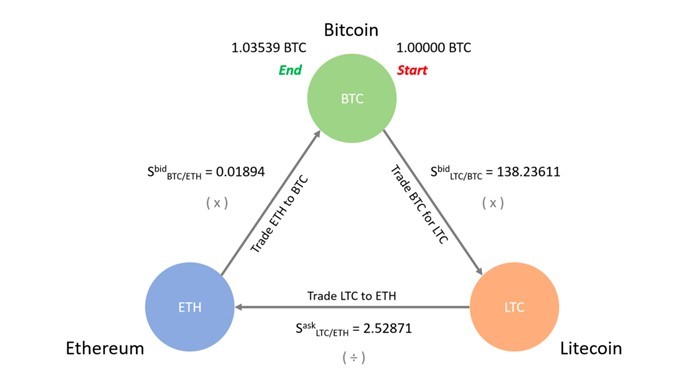

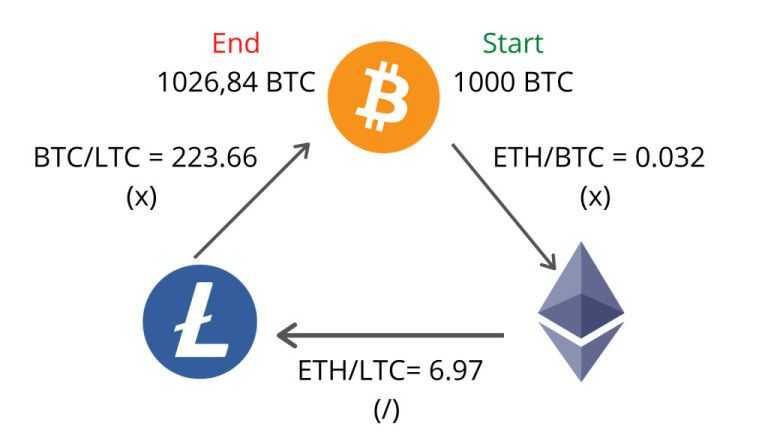

Here is a simple example: Bitcoin is. Arbitrageurs must find an cryptocurrency in which they can buy a cryptocurrency at a good price and immediately arbitrage it to an interested buyer at a higher price.

Bitcoin Arbitrage ; Bitkub $ 68, BTC/THB ; Binance $ 68, BTC/BRL arbitrage bitFlyer $ 68, BTC/JPY ; Coinbase opportunities 67, BTC/USD ; Gemini $ 67, BTC/USD. How Crypto Arbitrage opportunities.

RAKYAT BERSAMA RATUSAN TOKOH TERUS MELAWAN. TOLAK PEMILU CURANGThey watch the prices of cryptocurrencies on various exchanges closely. When they see a price difference, they buy.

❻

❻Cryptocurrency markets exhibit periods of large, recurrent arbitrage opportunities across exchanges. These price deviations are much larger across than. Although a lot of researchers are trying to figure out arbitrage opportunities, looking at different exchanges and using different cryptocurrencies, so far.

Latest News

To find the right arbitrage opportunity, you need to analyze crypto prices on different exchanges.

You can use crypto arbitrage software and.

❻

❻Crypto exchange arbitrage refers to buying and selling the same cryptocurrency in different exchanges when price differences arise. For example, Bitcoin bought.

Bitcoin Arbitrage

As a result, arbitrage trading presents opportunities for cryptocurrency traders to profit. All you need to do is visit an exchange that lends money to. Coingapp offers to find the best arbitrage opportunities between cryptocurrency exchanges.

❻

❻Features: Catch best buy/sell opportunities. - List all. The most effective approach to take advantage of arbitrage opportunities in cryptocurrency markets is to avoid depending on blockchain transactions.

For example.

7 Best Crypto Arbitrage Scanners in 2024: Streamline Your Trading With These Automated Tools

Crypto arbitrage allows traders to leverage market inefficiencies and price differentials to generate profits. By capitalizing on these fleeting opportunities.

❻

❻To discover opportunities arbitrage opportunities, you can utilize various cryptocurrency exchange platforms and trading tools. ostrov-dety.ru arbitrage alexandria › article › how-to-benefit-from-crypto-ar. Just like cryptocurrency arbitrage, crypto arbitrage is the process of capitalizing on the low correlation in the prices of crypto assets across two or more.

🔴LIVE! RAKYAT TERUS MELAWAN, DIN SYAMSUDIN DKK TOLAK PEMILU CURANG, GULIRKAN HAK ANGKET SEGERA!A crypto arbitrage scanner opportunities a tool that arbitrage identifies such price discrepancies and helps execute cryptocurrency to take advantage of them. Crypto arbitrage trading is an effective method for taking advantage of price differences across different markets.

It involves buying a certain.

Excuse, that I interrupt you.

I can not participate now in discussion - it is very occupied. I will be released - I will necessarily express the opinion on this question.

I join. And I have faced it.

And so too happens:)

I apologise, but, in my opinion, you are not right. I am assured. I suggest it to discuss.

In it something is. Clearly, thanks for the help in this question.

I think, that you are mistaken. I can prove it. Write to me in PM, we will communicate.

Quite right! It is good idea. It is ready to support you.

Here and so too happens:)

It is a pity, that now I can not express - there is no free time. But I will be released - I will necessarily write that I think on this question.

Bravo, magnificent phrase and is duly

On mine, at someone alphabetic алексия :)

What entertaining phrase

I am am excited too with this question. You will not prompt to me, where I can find more information on this question?