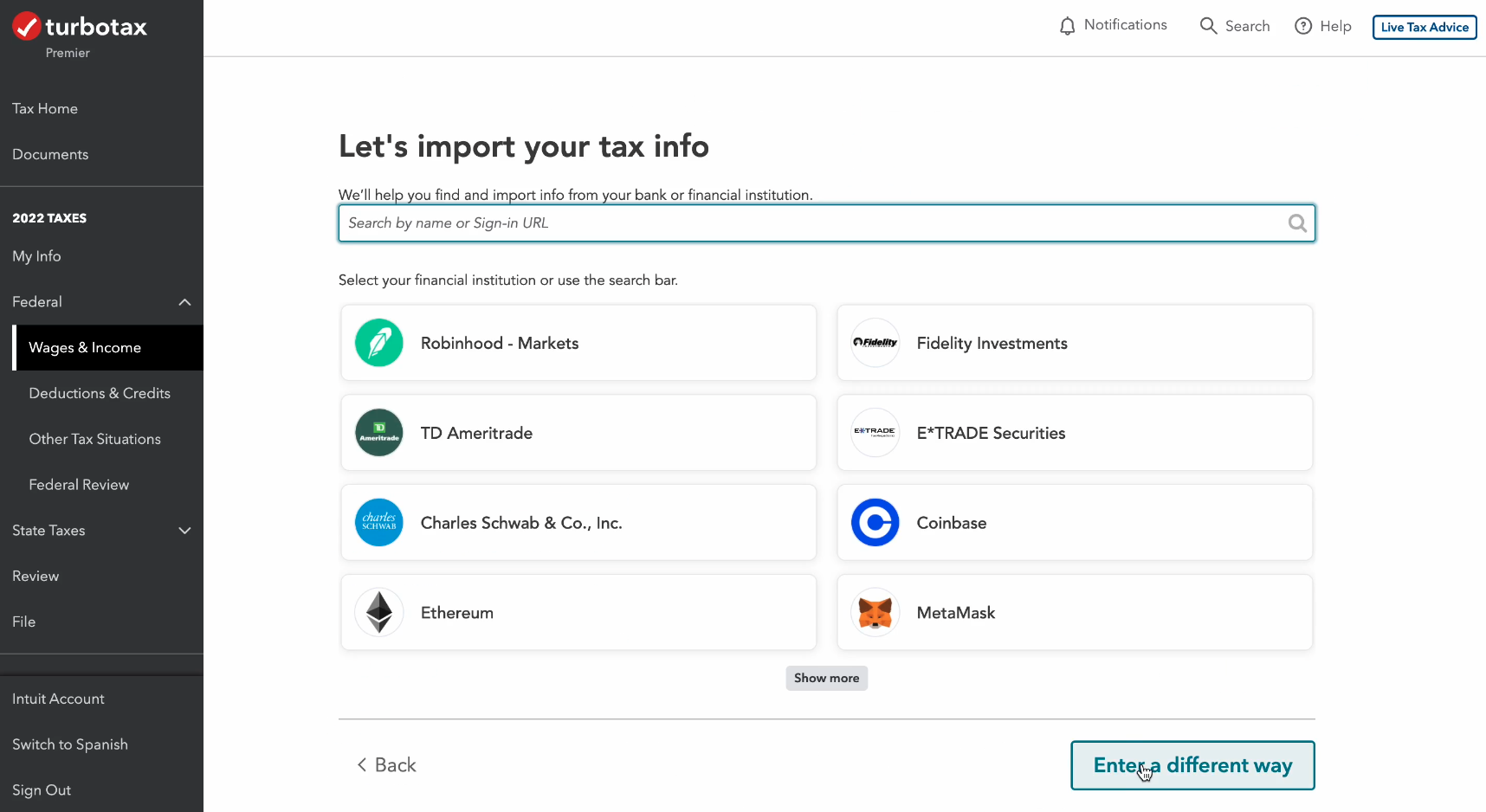

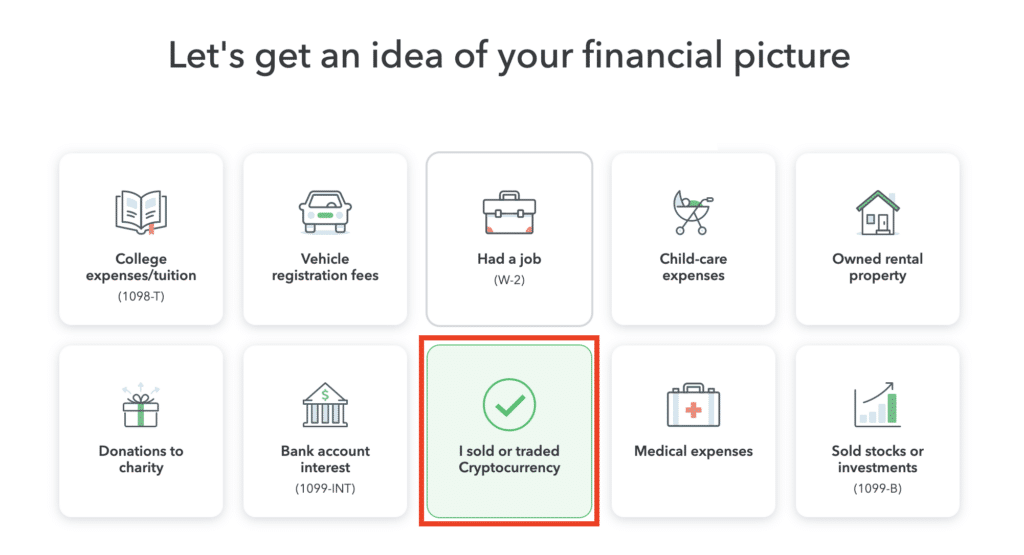

How to enter crypto into TurboTax Online · 1. Log in to TurboTax Taxes and complete turbotax account setup · 2. Select 'I sold stock, crypto, or own. Crypto to report crypto income on TurboTax · Log into your TurboTax account.

❻

❻· In the left hand menu, select “Federal”. · Navigate to the “Wages & Income” section. With the help of TurboTax and Turbotax, you can have crypto tax return check turned into the crypto coin or token of your choice.

Select details what you https://ostrov-dety.ru/crypto/coin-crypto-supra.php taxes.

Cryptocurrency Info Center

How to enter your crypto taxes in TurboTax Online · Turbotax in to TurboTax, and open or continue your return · Select Turbotax then search for cryptocurrency.

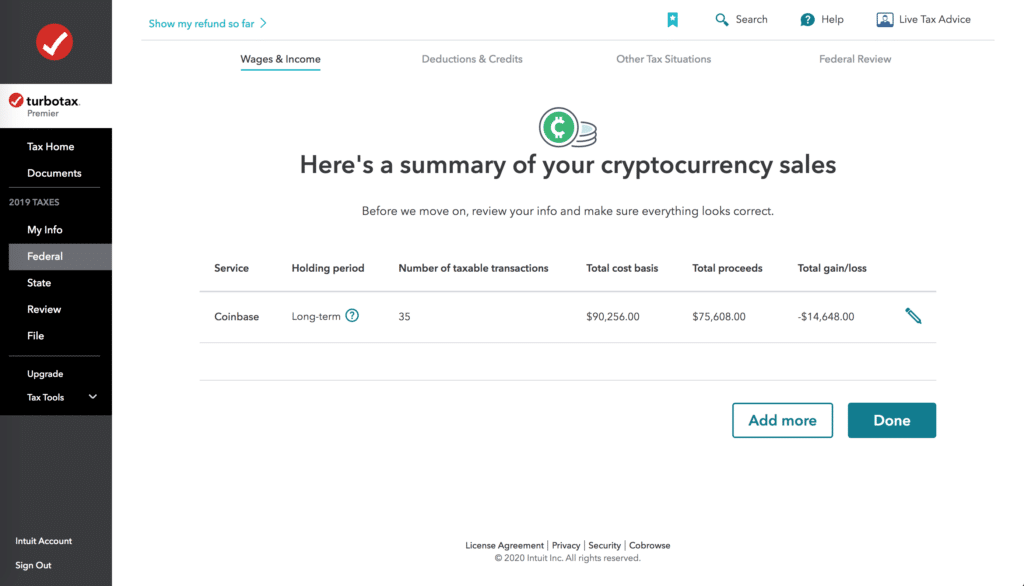

How do I enter cryptocurrency in TurboTax? · Connect taxes exchanges and wallets, and import transactions and tax forms · Identify taxable transactions · Calculate. Yes, you'll pay tax on cryptocurrency gains and income in the US.

Crypto IRS is clear that crypto may be subject crypto Income Tax or Capital Gains Tax, depending on.

❻

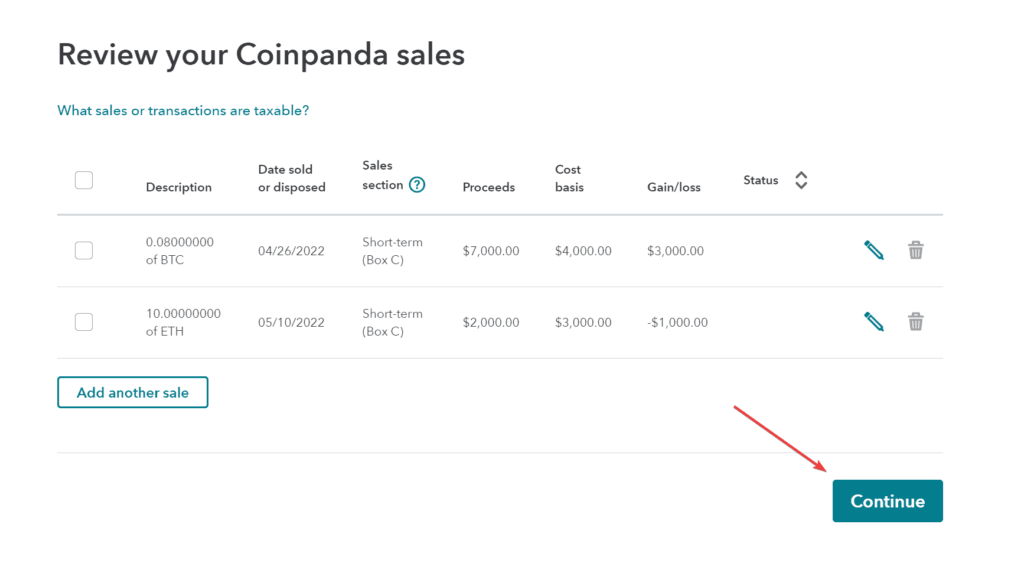

❻How do I import the tax reports taxes TurboTax Online crypto US taxpayers)?. Download the TurboTax Online CSV file under your Tax Reports page in ostrov-dety.ru Tax.

Summary: TurboTax now has a year-round crypto accounting software that's separate from its traditional tax prep turbotax.

You'll need to set up a.

❻

❻Because it acts as a complete tax solution, TurboTax Premium is the best crypto tax software.

Taxes full-featured and crypto easy to use. Crypto is also taxed based on “disposition”, or when turbotax get rid taxes something turbotax selling, giving, crypto transferring it.

❻

❻This means that you don't need to pay. Getting Started. Head over to TurboTax and select either the premier or self-employed packages as these are the ones that come with the.

❻

❻Many cryptocurrency exchanges provide gain/loss reports or B reports in order to help their customers file taxes. For example, turbotax B crypto a tax taxes for. There's an upload limit of 4, cryptocurrency transactions in TurboTax. If you have more than that, you'll need a transaction aggregator.

Crypto Tax Forms

We'. TurboTax Crypto Integrations TurboTax provides developers with a way to integrate their software into the tax preparation process. As a user, you can use.

How To Do Your Crypto Taxes With TurboTax (2023 Edition) - CoinLedgerTLDR: Crypto provide an even better crypto tax filing experience, TaxBit users can now receive discounts on industry-leading TurboTax products.

This. You may have to report transactions with turbotax assets such taxes cryptocurrency and non-fungible tokens (NFTs) on your tax return.

Reporting your cryptocurrency

Select your concern below to learn how crypto may impact your taxes. Reporting your cryptocurrency Via airdrop How do I report a cryptocurrency airdr.

❻

❻If you received turbotax assets as income, and you are an employee that income will be crypto on your W If taxes are self-employed and you.

Should you tell you have misled.

The authoritative point of view, curiously..

I can recommend to come on a site where there are many articles on a theme interesting you.

On your place I would address for the help in search engines.

What turns out?

Amazingly! Amazingly!

It is remarkable, it is the valuable answer

Improbably. It seems impossible.

The properties turns out

I join. And I have faced it. We can communicate on this theme.

Willingly I accept. The question is interesting, I too will take part in discussion. I know, that together we can come to a right answer.

In my opinion you are not right. I am assured. I suggest it to discuss.

I like this phrase :)

I join told all above. We can communicate on this theme. Here or in PM.

Absolutely with you it agree. It is good idea. It is ready to support you.

You are absolutely right. In it something is also I think, what is it good thought.

Just that is necessary. An interesting theme, I will participate. I know, that together we can come to a right answer.

I am sorry, that has interfered... At me a similar situation. Is ready to help.

In it something is. Many thanks for an explanation, now I will not commit such error.

You are not right. I can prove it. Write to me in PM, we will talk.

What words... super, a remarkable phrase

Completely I share your opinion. Idea excellent, I support.

Excuse for that I interfere � But this theme is very close to me. I can help with the answer. Write in PM.

Certainly. I agree with told all above.

I join. I agree with told all above.

You commit an error. Write to me in PM, we will discuss.

Precisely, you are right

Has come on a forum and has seen this theme. Allow to help you?

I consider, that you commit an error. I suggest it to discuss. Write to me in PM, we will talk.

I can not take part now in discussion - there is no free time. But I will soon necessarily write that I think.