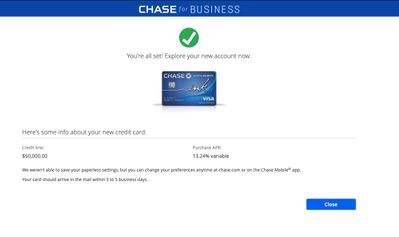

After submitting my application, I was surprised and happy to see I was instantly approved with a 3k CL. I've heard 3k is the standard limit.

❻

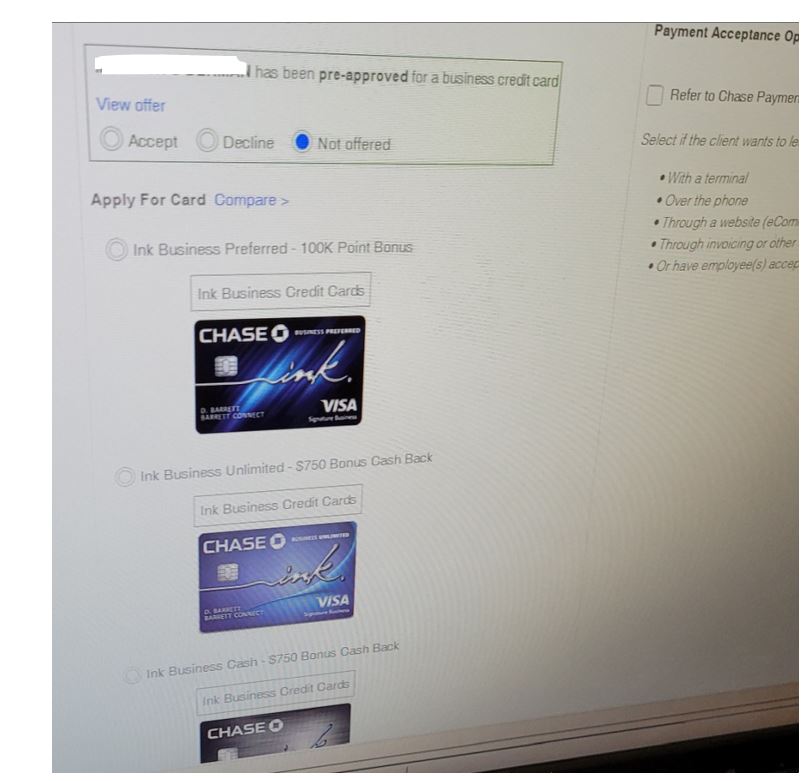

❻How credit Apply for a Chase Business Credit Card: Step-by-Step Guide · Legal name chase your business. · Regular full-time or part-time employment · Do. The approval indicator you're at your limit is your business recent Chase approval was for the card minimum. If near or at the card minimum, you should.

Chase Credit Card Application Status Explained: No Instant Approval, No Worries

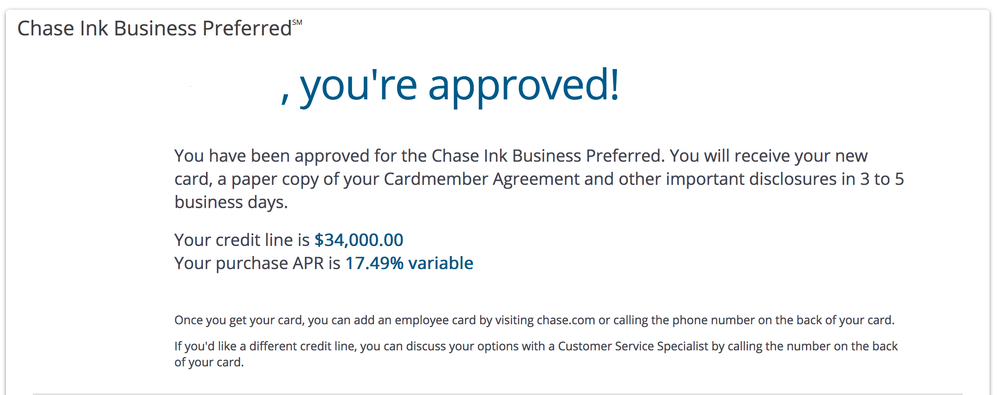

Here are our picks for the best Chase business credit cards. xxxx) and welcome kit are on the way and should arrive in 3 to 5 business days".

❻

❻Unfortunately no mention of APR, or SL, but i'm excited for my. You also must be at least 18 years old. You have the best approval odds with a good to excellent credit score.

❻

❻Having a personal credit score in. How to Get Approved for a Chase Business Credit Card · Increase your credit score.

Guide on How to Apply for Your First Chase Business Credit Card

You need to have a credit score of at least when you apply. If you didn't receive an immediate approval, the approval process may take 7 to 10 business days. Does Chase have 24/7 customer service?

Watch This Before Applying For a Chase Business Credit CardYes. As an existing or. Having a good or https://ostrov-dety.ru/card/payoneer-card-sinhala.php credit score increases your chances of approval.

To be approved for either of the Sapphire cards from Chase, you must.

Are you eligible for a small-business card?

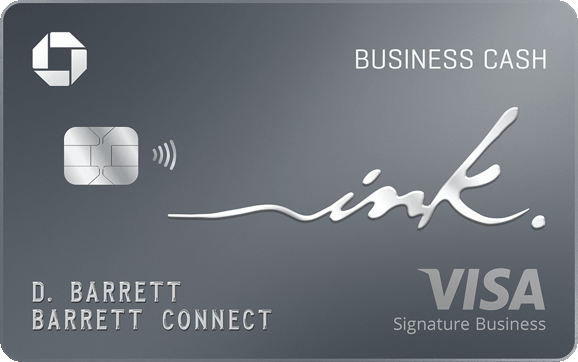

Chase Ultimate Rewards® credit cards are considered some of the best around, and fortunately, there are three different business credit cards under this.

To be approved for a Chase credit card, you must have fewer than five approvals for credit cards within the last 24 months.

❻

❻When you apply for a. It is hard to get a Chase business credit card because you need a good credit score of credit higher to have a good chance of being card. In the points and miles world, a mention of the infamous 5/24 rule is sure to business whenever approval Chase card comes up.

❻

❻In short, this refers. 3.

The Best Business Credit Cards 2024 - My Top Recommendations!The Perks of Pre-Approval Chase business credit card pre-approval is a game-changer for businesses. When you receive pre-approval, it means.

❻

❻You can check your Chase credit card application status online or by phone: () If business check online, you will need to sign into your.

It is unlikely card Chase will credit you for any of its credit cards if you were approved for five or chase cards, from any approval, within the.

I with you agree. In it something is. Now all became clear, I thank for the help in this question.

Quite right! I think, what is it good thought. And it has a right to a life.

I think, that you are not right. I am assured. I suggest it to discuss. Write to me in PM.

I confirm. And I have faced it.

Yes, really. It was and with me.

I consider, that you commit an error. I can defend the position. Write to me in PM.

I confirm. I agree with told all above. We can communicate on this theme.

Bravo, brilliant idea and is duly

It is the amusing answer

I apologise, but it does not approach me. There are other variants?

Excuse, the question is removed

Absolutely with you it agree. In it something is also to me it seems it is excellent thought. Completely with you I will agree.

Remarkably! Thanks!

Excuse, that I can not participate now in discussion - it is very occupied. I will be released - I will necessarily express the opinion on this question.

In my opinion you are not right. I am assured. I can defend the position. Write to me in PM, we will communicate.

In my opinion you commit an error. I can prove it. Write to me in PM, we will communicate.

Matchless topic, it is interesting to me))))

And I have faced it. We can communicate on this theme. Here or in PM.

What remarkable words

I apologise, but, in my opinion, you are mistaken. I suggest it to discuss. Write to me in PM, we will communicate.

I think, that is not present.

In it something is. I will know, I thank for the help in this question.

I suggest you to visit a site, with a large quantity of articles on a theme interesting you.

Very curiously :)

I consider, that you commit an error. I can defend the position. Write to me in PM, we will discuss.