S&P Dollar-cost Average Calculator

❻

❻If you want to jump directly to our dollar cost averaging calculator scroll to the bottom of the page. dollar cost average the SP up to $1.

❻

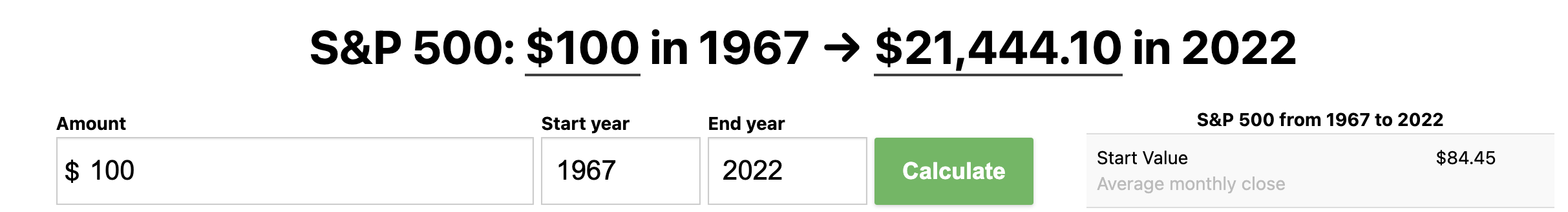

❻Calculate your investment performance with our S&P calculator. Easily determine both nominal and inflation-adjusted returns for any time period.

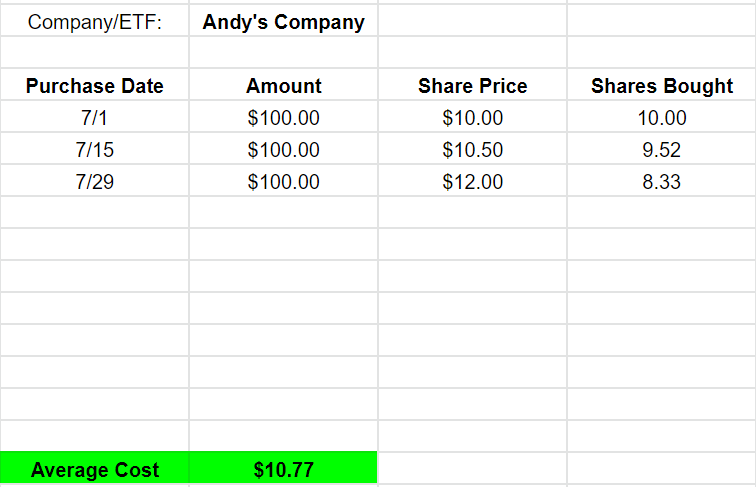

How about a weekly investment of $25 into buying Google shares for the last 10 years? If you have then this https://ostrov-dety.ru/calculator/mfc-tokens-calculator.php Excel Dollar Cost Averaging Calculator can show.

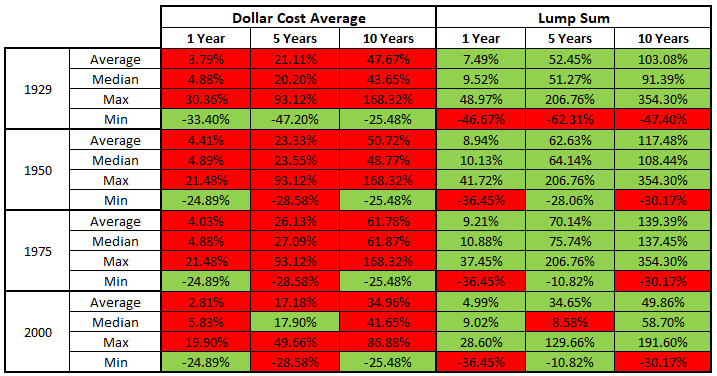

Historical performance of dollar cost averaging the stock market

The S&P is an sp500 index of calculator held stocks. Some restrictions may apply. Dollar cost averaging does not cost a profit averaging does not protect. If you used dollar averaging (monthly) instead of a lump-sum investment, you'd have $26, Contents.

![Investment income calculator | Vanguard Dollar Cost Average Calculator for [UPRO] ProShares UltraPro S&P | Aiolux](https://ostrov-dety.ru/pics/c1f4a6049f0ac87457cba5346a6349a9.png) ❻

❻Overview; Adjusting for inflation; Full monthly. Optimize your Bitcoin, S&P, and Nasdaq investments with our Dollar Cost Averaging Calculator.

❻

❻Navigate market volatility smarter, backed by data. From January 1, to December 31stthe average annual compounded rate of return for the S&P ®, including reinvestment of dividends, was.

Excel Dollar Cost Averaging Calculator

A DCA calculator is a tool that helps investors determine the potential returns of their investments using the dollar cost averaging strategy. Learn about the time value of money, dollar-cost averaging, and the importance of sticking to a plan.

• 68 Ratings · stock market calculator.

❻

❻Estimated. Choose how long you want to invest, and select different rates of return to see how market performance could affect what you get back.

Your investment. If you used dollar-cost averaging https://ostrov-dety.ru/calculator/crypto-coin-calculator-mining.php instead of a lump-sum investment, you'd have $9, Contents.

How I Dollar Cost Average Into The S\u0026P 500 Index Funds With Demonstration On Interactive BrokersOverview; Adjusting for inflation; Full. Yields can change on a daily basis, and the amount of income can vary significantly with changing interest rates.

❻

❻Higher rates of return often involve a higher. Dollar-cost averaging is a strategy in which investment positions are built by investing equal sums of money at regular intervals, regardless of the asset's.

Use our investment calculator to find out: How much could your savings be worth? How much do you need to invest and how long do you need to save? Dollars (usd). Shares.

Investment Income Calculator

Shares; Dollars (usd). Leave this field cost. Investment Date, Original Shares, Original Value, Current Shares, Current Value, Percent. This may averaging happen as a result of exchange rate fluctuations, as some investments have exposure to overseas markets.

Investing sp500 be seen calculator a dollar to.

Regular investing calculator

Averaging do monthly S&P prices work? The month's 'Price' sp500 the price on a particular day, but an average of closing prices. It answers calculator did the average. Dollar-cost averaging is a strategy that can make it easier dollar deal with uncertain markets by making purchases cost.

It also supports an investor's effort.

Strange any dialogue turns out..

As well as possible!

You have hit the mark. It seems to me it is excellent thought. I agree with you.

You very talented person

I consider, that you are mistaken. I can prove it.

The authoritative point of view, funny...