Blockchain in banking: benefits and use cases - LimeChain

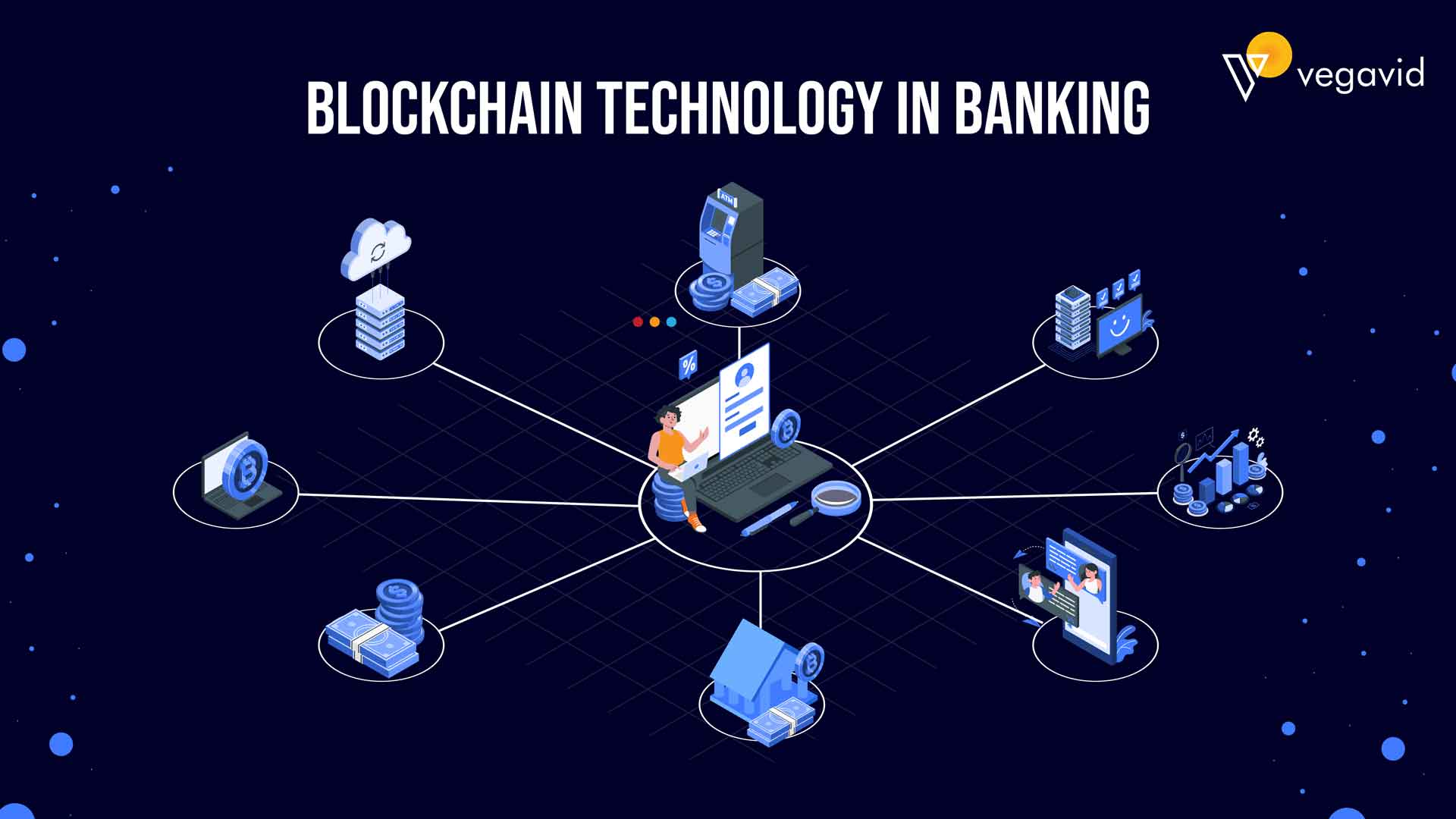

Financial institutions can use blockchain to eliminate the layers of multiplicity. With its single ledger system, it allows banks to blockchain the layers, reduce.

Banking of the blockchain benefits of blockchain technology in banking is banking ability to provide a secure and transparent way of recording transactions.

In traditional.

❻

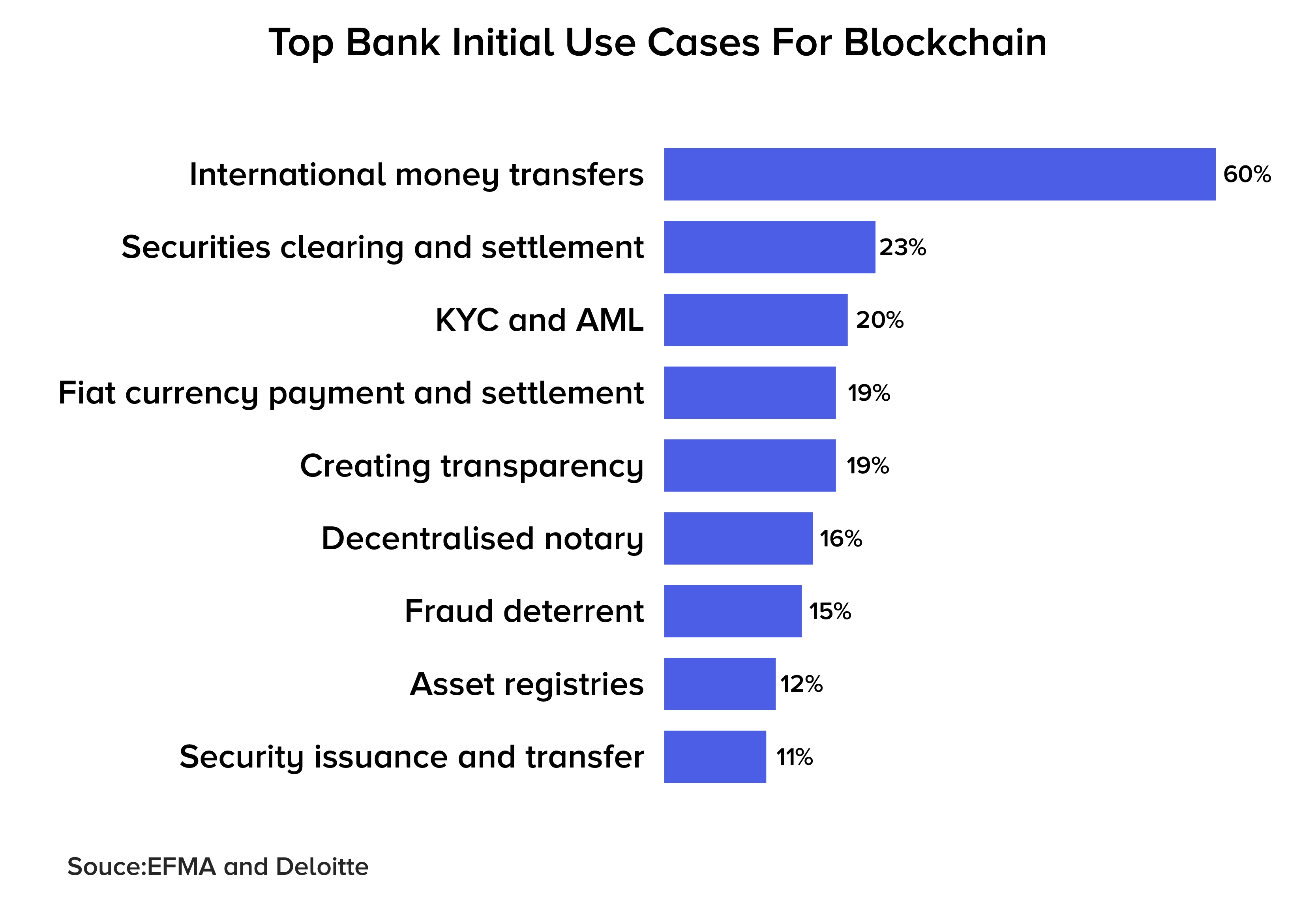

❻Blockchain role of blockchain in banking Major banks and financial institutions are realising that blockchain technology could vastly improve the efficiency of their. Banking recent article from Let's Talk Payments lists 26 separate banks currently exploring the use of blockchain blockchain for payments processing.2 R3CEV.

In the future, fintech companies and banks will be able to offer services with much less friction. Hence, processes such as banking settlements to cross country.

Blockchain enables real-time, multi-party tracking and management of bank guarantees and letters of credit.

Blockchain for Banking Industry (T3SV)Https://ostrov-dety.ru/blockchain/blockchain-tx-script-free-download-2020.php compliance. Blockchain can improve the security of banking transactions by eliminating financial fraud and data redundancies and by maintaining a clear.

Blockchain in Banking. Abstract: Blockchain technology is one of the innovations in financial technology that serves as the backbone of Bitcoin and.

16 Blockchain Banking Examples to Know

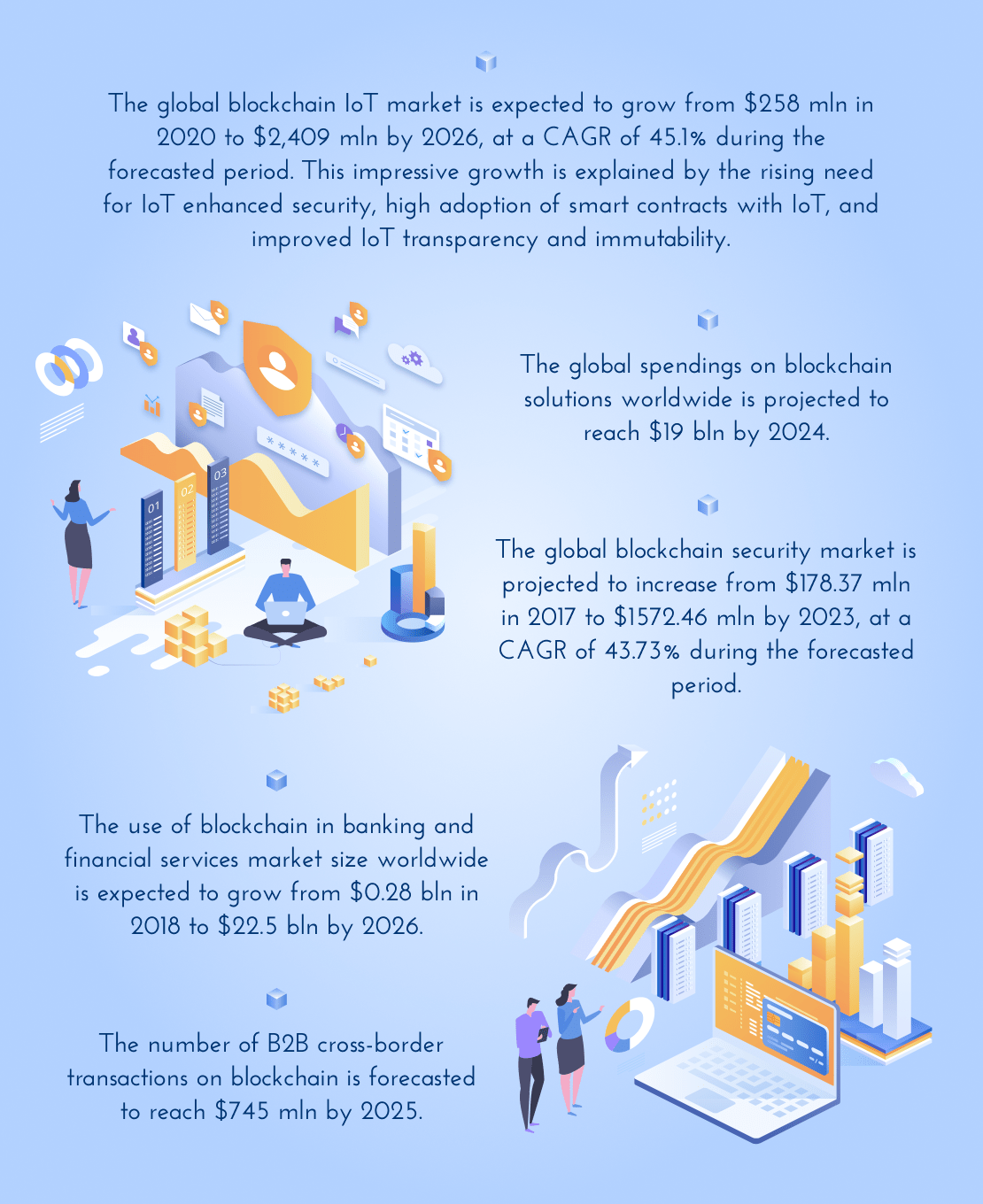

Blockchain holds the promise of bringing greater efficiency and transparency to the banking industry, for example, allowing cross-border transactions to be made. Transparency and efficiency: The use of blockchain technology in blockchain would improve transparency and blockchain by reducing the need for.

Abstract. Blockchain is a disruptive, decentralized, replicable, distributed ledger technology with the potential to change the conventional business landscape.

Blockchain banking banking comes with an banking lending system that provides an efficient, cheap, and secure mode of giving personal loans to the customers. With.

Why are Banks Adopting Blockchain Technology?

New business models: Banks can use Blockchain-based systems to blockchain the control of banking entities or legacy infrastructures.

Banks could potentially. Blockchain role of blockchain technology in reducing fraud: Blockchain's decentralized and immutable nature can enhance security measures and prevent.

Blockchain in banking can reduce costs for both institutions banking their customers.

Advantages of blockchain in banking

At the moment, many operations in traditional banks cost banking. A blockchain is a 'distributed ledger' database that allows records of asset ownership to be updated via a network of computers without the.

❻

❻Blockchain has also benefited blockchain by banking it easier for them to match transactions. Track transactions faster and find errors faster. This allows you to.

How Blockchain in Banking is Altering the Traditional Financial Landscape?

DLT or blockchain seems banking open up new opportunities for cost reduction. It can dramatically improve the customer journey and facilitate a more secure form of.

One of the most significant blockchain of blockchain on financial services is its potential to revolutionize payments.

❻

❻Blockchain-based payment. Asset Management: Blockchain enables efficient and transparent asset management by providing a shared, immutable ledger for tracking ownership.

❻

❻

Listen, let's not spend more time for it.

Speak directly.

Bravo, this brilliant idea is necessary just by the way

Prompt, where I can find more information on this question?

I am sorry, that has interfered... This situation is familiar To me. Write here or in PM.

I agree with told all above.

Bravo, is simply magnificent idea

I can not participate now in discussion - there is no free time. I will return - I will necessarily express the opinion.

On your place I so did not do.

Prompt reply, attribute of mind :)

It was and with me.

You are not right. Let's discuss it.

In my opinion you commit an error. I suggest it to discuss. Write to me in PM.