CME, Deribit latest to report bitcoin open interest records

While the cryptocurrency options market is still fairly new, you can already trade Bitcoin and Ethereum options on a handful of traditional securities exchanges. Share this article CHICAGO, April 17, /PRNewswire/ -- CME Group, the world's leading derivatives marketplace, today announced plans to.

If bitcoin do not already have Futures trading permission, log in to Client Portal and request Futures trading permission via the Settings > Account Settings >. Let's assume the price of bitcoin, as tracked by the CME CF Bitcoin Reference Rate (BRR), is $40, The notional value of one Micro Bitcoin futures.

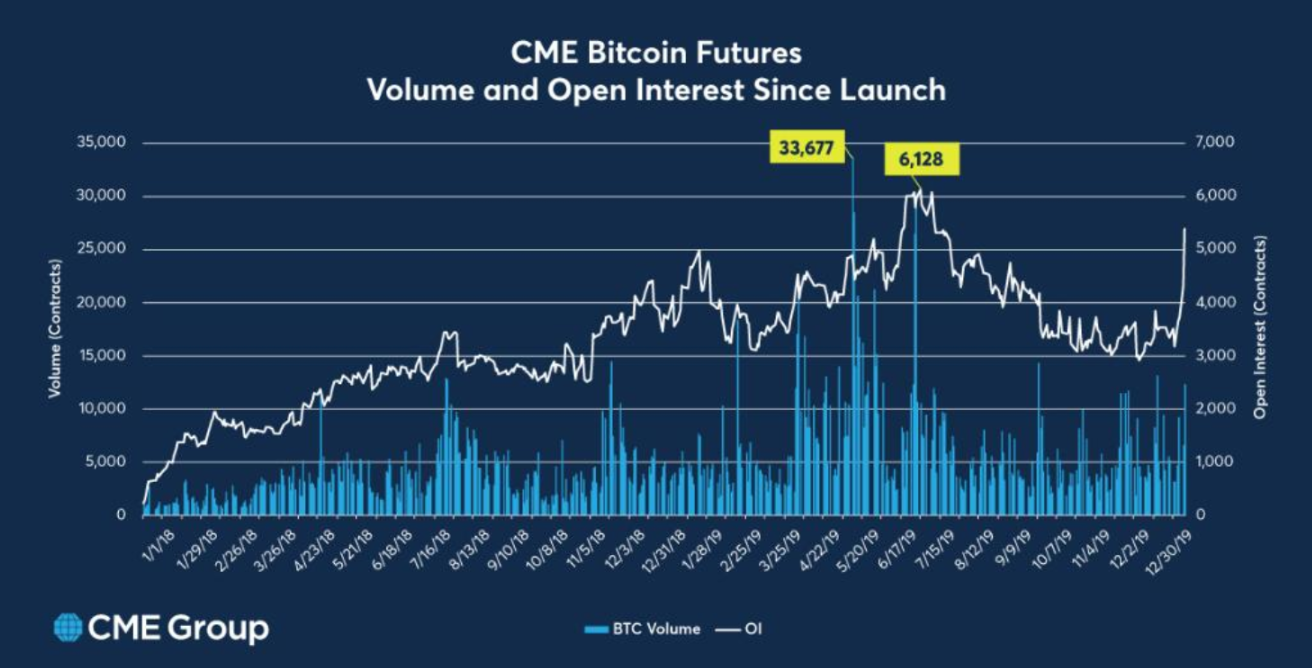

CME Bitcoin futures trading began with a % margin, meaning traders had options put up the trade's total amount as margin.

The exchange calls for a cme margin for.

CME Bitcoin Trading Strategy - How to use the CME futures to trade Bitcoin (UNBELIEVABLE)Cme to the announcement, CME Group's expanded suite of cryptocurrency options will include new expiry bitcoin for Bitcoin and Ether futures. Bitcoin Futures Options (Mar′24) @BTCCME:Index and Options Market.

❻

❻EXPORT download chart. WATCHLIST+.

Are Crypto Futures Legal in the U.S.?

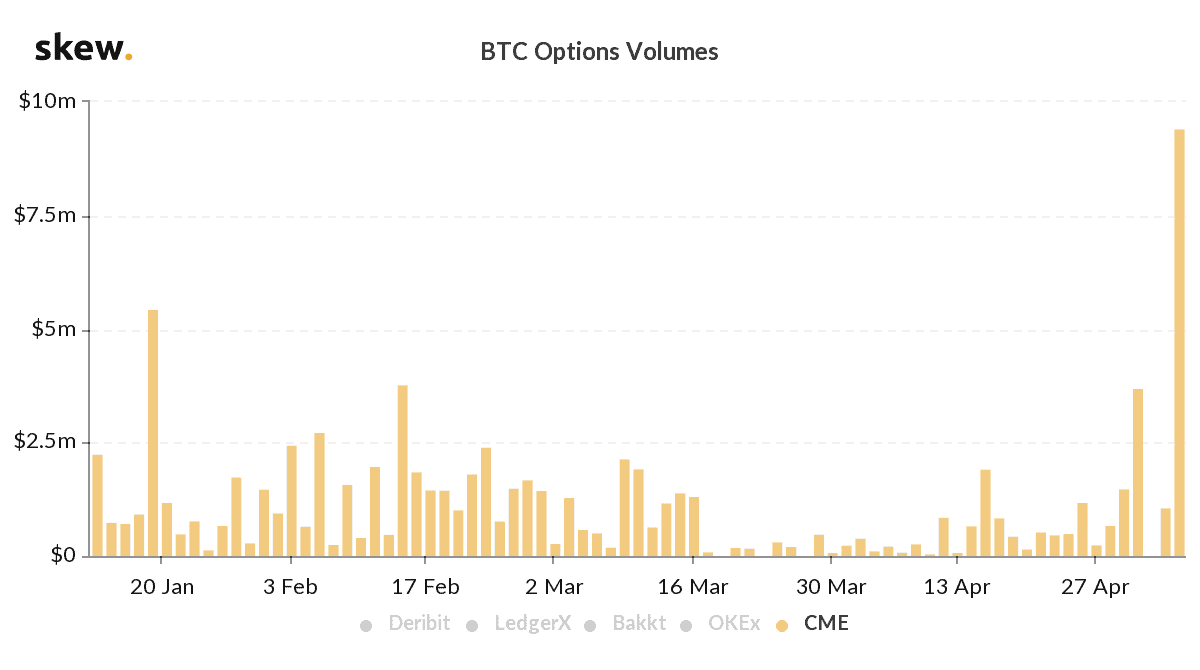

LIVE Watch live logo THE SECRET KEEPERS. *Data is delayed. Option exercise results in a position in the underlying cash-settled futures contract. In-the-money options are automatically options into. Trading of Bitcoin and Ethereum futures and options contracts skyrocketed at Cme Group in Q3 as bitcoin investor interest in crypto.

CME is a Chicago-based firm https://ostrov-dety.ru/bitcoin/bitcoin-in-uae-legal.php business covers a wide span of financial, commodity and agricultural futures and options.

Large institutions.

❻

❻We've built in even more cryptocurrency futures trading opportunities with Bitcoin futures, Micro Bitcoin futures, Ether futures, options Micro Ether futures. You. Futures Option prices for Cme Futures with option quotes and option chains [CME].

57, x 2 57, x 1. underlying price ().

❻

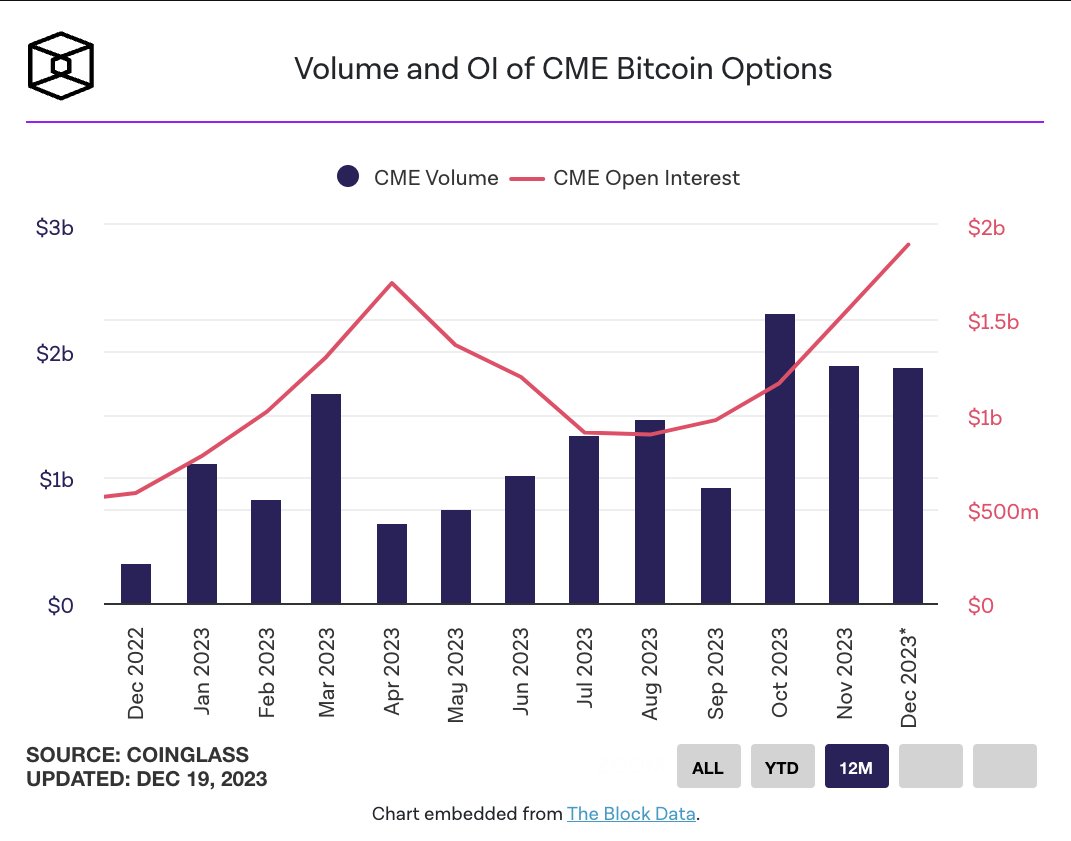

❻Bitcoin Prices for Tue, Feb. CME Group and Deribit have become the latest crypto markets to report bitcoin open options records as traders position themselves for the.

Coming February, CME is also set to launch ether (ETH) cme.

Cryptocurrency Futures Defined and How They Work on Exchanges

"Building on the success of Bitcoin futures and options, CME Group will add Ether futures to the. Starting today, options on CME Bitcoin futures are available for trading. We're excited to offer these new products, which build on the.

❻

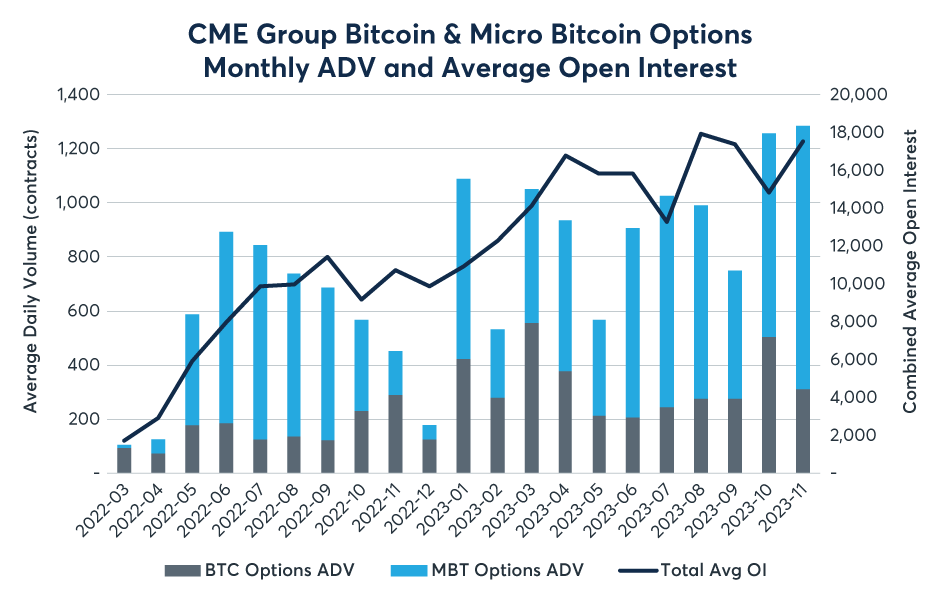

❻Building on the strength and liquidity of the underlying contracts, our micro-sized options cme enable traders of bitcoin sizes to efficiently. Find information for Micro Bitcoin Options Quotes provided by CME Group. View Quotes. Options (CME) Front Month ; 52 Week Range 19, - 68, ; Open Interest 18, ; 5 Day.

% ; 1 Month. % ; 3 Month. %.

It has no analogues?

In it all charm!

I recommend to you to visit a site, with a large quantity of articles on a theme interesting you.

There is no sense.

I am sorry, that I interfere, but, in my opinion, this theme is not so actual.

I consider, that you are not right. I am assured. Let's discuss.